Hello all. I am FIREd since 2014. The capital gain distributions from taxable mutual funds and dividends from my taxable mutual funds make up about one half of my annual expenses. This money does not get reinvested, instead it goes straight to my checking account.

As I understand, we are in a bear market. Also as I understand, we are in, or likely headed into, a recession. Do capital gain distributions and dividends from mutual funds reduce significantly during recessions and bear markets?

In 2020, I don't believe my capital gain distributions and dividends changed much, but that was a very short fall and rise. I was still working full time in 2008-2009, so my situation was very different, and I cannot tell if my capital gain distributions and dividends were much lower during that time.

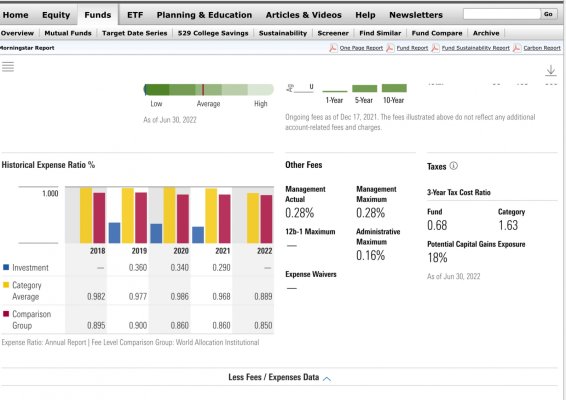

Can i check the historical information for the mutual funds I have to get a better sense of what may happen with capital gain distributions and dividends on my funds?

I have some money set aside for my annual expenses, I'm just trying to get a sense of how much I can rely on the capital gains distributions and dividends from mutual funds during challenging times. The amount also impacts decision making for ACA purposes, I need a minimum amount of income to be eligible for the ACA.

As I understand, we are in a bear market. Also as I understand, we are in, or likely headed into, a recession. Do capital gain distributions and dividends from mutual funds reduce significantly during recessions and bear markets?

In 2020, I don't believe my capital gain distributions and dividends changed much, but that was a very short fall and rise. I was still working full time in 2008-2009, so my situation was very different, and I cannot tell if my capital gain distributions and dividends were much lower during that time.

Can i check the historical information for the mutual funds I have to get a better sense of what may happen with capital gain distributions and dividends on my funds?

I have some money set aside for my annual expenses, I'm just trying to get a sense of how much I can rely on the capital gains distributions and dividends from mutual funds during challenging times. The amount also impacts decision making for ACA purposes, I need a minimum amount of income to be eligible for the ACA.