Where do you stash cash? Well not exactly cash money in greenbacks, but easy to access money that I can turn into cash.

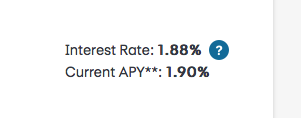

I have a few hundred in a local credit union, and somewhere between 10-20 thousand in a vanguard money market account. I auto transfer out of that VG account for reoccurring bills. And I use it as a slush fund if I ever need it. Maybe once every couple years i need it for that. But I have a lot more than I normally need in that account, especially since it does pay much in interest.

Is there a better way? Should I just lower my mm account totals?

I have a few hundred in a local credit union, and somewhere between 10-20 thousand in a vanguard money market account. I auto transfer out of that VG account for reoccurring bills. And I use it as a slush fund if I ever need it. Maybe once every couple years i need it for that. But I have a lot more than I normally need in that account, especially since it does pay much in interest.

Is there a better way? Should I just lower my mm account totals?