Actually, selecting for dividend stocks is a suboptimal strategy, as has been debated here many times. Dr. Ken French explains in this brief video: https://famafrench.dimensional.com/videos/homemade-dividends.aspx

+1

Actually, selecting for dividend stocks is a suboptimal strategy, as has been debated here many times. Dr. Ken French explains in this brief video: https://famafrench.dimensional.com/videos/homemade-dividends.aspx

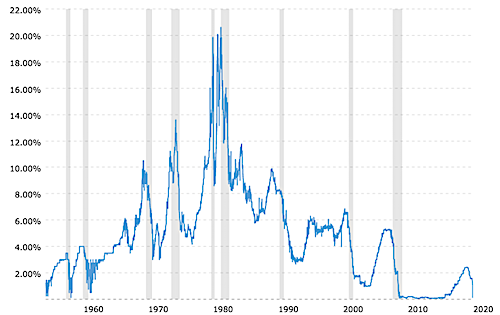

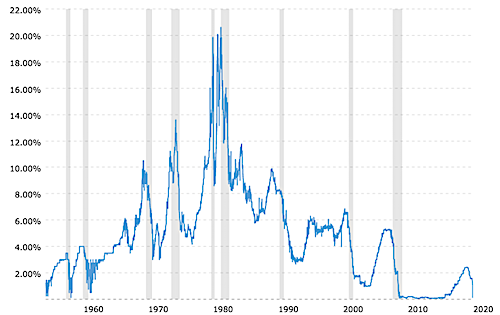

Because as you well know, the portfolio steadying effect of cash and bonds hasn't performed this poorly for several generations. Sooner or later (all types of) bond NAVs have to go down before they can go up again, and interest rates haven't been this bad this long for a long, long time. Add high PE market multiples and a recent inflation spike, and it's no wonder people are searching for "answers" once again. Unfortunately there's no place to hide...Equities, bonds, cash, PMs, RE, etc. We all have our portfolios. Most of our portfolios have been up - way up, the past few years. We don't sell our stocks or bonds or REITs or gold because they drop in value. We rebalance and wait for happier days. In the case of cash, it allows us to "live" without selling a depressed component of our portfolio. Why would we "sell" our cash when it can't keep up with inflation? It's still performing its function within our portfolio. Stay the course is what we hear when anything else is depressed. Why is cash any different? YMMV

Because as you well know, the portfolio steadying effect of cash and bonds hasn't performed this poorly for several generations. Sooner or later (all types of) bond NAVs have to go down before they can go up again, and interest rates haven't been this bad this long for a long, long time. Add high PE market multiples and a recent inflation spike, and it's no wonder people are searching for "answers" once again. Unfortunately there's no place to hide...

"The later Stoics of Roman Imperial times, Seneca and Epictetus, emphasize the doctrines ... that the sage is utterly immune to misfortune and that virtue is sufficient for happiness." https://plato.stanford.edu/entries/stoicism/... Unfortunately there's no place to hide ...

Actually, selecting for dividend stocks is a suboptimal strategy, as has been debated here many times. Dr. Ken French explains in this brief video: https://famafrench.dimensional.com/videos/homemade-dividends.aspx

buying equities at these levels seems to be just as bad.

That happens with these threads every time. Someone always says take more risk…which isn’t a cash alternative. Neither are ST bonds unless you buy and hold to maturity.We are far afield of the OPs question. Surely dividend stocks or equities of any sort are not cash alternatives.

Maybe ST bonds but that's about it.

+1Yes. that is a sobering chart to me. I am just old enough to remember 16% mortgages and also 12% CD's. I'd obviously take the latter right now.

Natural enough. I think we humans have evolved to hate problems for which there are no solutions, like increasing yield on cash without increasing risk. So we flail.That happens with these threads every time. Someone always says take more risk…which isn’t a cash alternative. Neither are ST bonds unless you buy and hold to maturity.

Why not I Bonds? If one may need cash quickly, leave some $$$ in savings.

I have Bonds going back to the 90's, and I'm buying new I Bonds now.

If an unlikely event requires me to tap into cash beyond my liquid savings, can always cash in older Bonds.

There are few risk free alternatives to cash, but here are a few:

1). IBonds- 10k limit per taxpayer, per year purchase limit, but currently paying a rate over 7%. I believe these bonds should be part of everyone’s allocation.

2). If you have a Traditional IRA, and a 401k with a stable value fund- find out if they allow an IRA rollover to the 401k (reverse rollover), and then buy into the SV fund (I have done just this starting a little over a year ago with about 60% of my bond holdings). Current SV yield in my 401k is 2.4%- better than the losses racked up by most bond index funds this year.

3) Bank hi yield savings accounts paying around .50%.

These are generally the best risk free options, but there are other alts with some risk such as: hi yield corporates, and preferred stock index etfs (some of which I do have allocations to.

Why not I Bonds? If one may need cash quickly, leave some $$$ in savings.

I have Bonds going back to the 90's, and I'm buying new I Bonds now.

If an unlikely event requires me to tap into cash beyond my liquid savings, can always cash in older Bonds.

The OP appears long gone, so I won’t bother to comment.

In addition to our stock mutual funds and stock brokerage account ( taxable and tax deferred), we have $200,000 in cash and another $250, 000 in a stable value fund inside a 401k. Then we have $155,000 in a treasury money market in an IRA. So a lot if cash.

That $200,000 we have to live on for 4 years of Roth conversions - and pay the taxes on the Roth conversions- starting next year- so no way and I am investing it.

Some of the $155,000 in the IRA I will be investing per my financial advisor’s advice in a few weeks. Most likely bond funds.

I want to keep the stable value fund as a future emergency fund.

I did just purchase $10,000 in I Bonds and over the past years that is where I put extra cash for a better return. I could have done another $10,000 this month under my spouse’s name but I felt it was cutting it too close in terms of the cash needed for future living expenses during the Roth conversions. I don’t want to touch IRA or taxable brokerage account money until after the conversions are over, SS starts for husband ( age 70)and his required RMDs kick in at age 72.

My SS ( age 70)will come two years after his. Then I guess my RMDs at age 72 after that.

Phew!

Reading the quotations here: Taylor Larimore's market timing quotes https://www.bogleheads.org/wiki/Taylor_Larimore's_market_timing_quotes always makes me smile.