RetireBy90

Thinks s/he gets paid by the post

SS needs a better ratio of working people to retired people.

COVID did a decent job of killing off lots of us older folks (I'm 72).

So maybe we need to make more younger folks now...

More immigration would help as they tend to have more kids. Wouldn’t solve the problem by itself but may help.

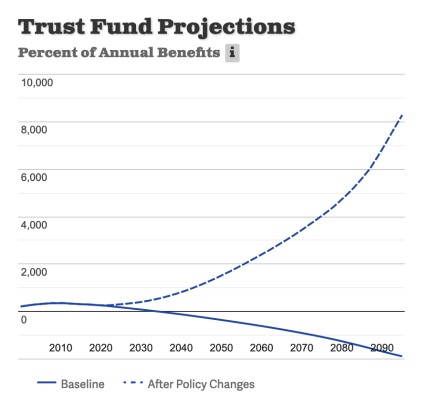

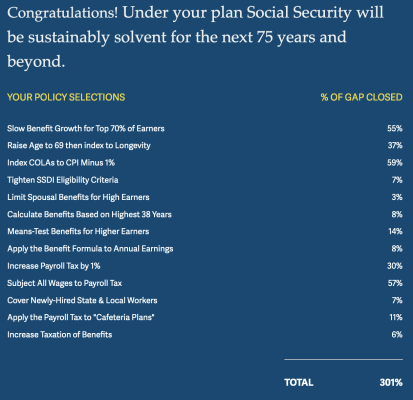

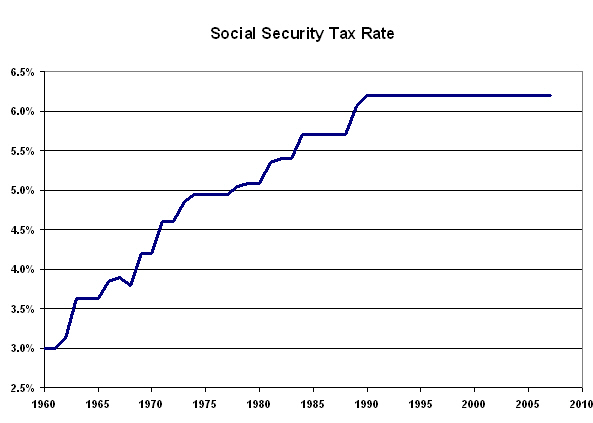

The WSJ piece mentioned above also stated in 1935 SS had 42 people contributing for every 65 year old retiree and by 2019 there were only 2.7 workers per retiree. The system is broken. There are temp solutions but it is like the tax code in that the original program doesn’t work with so few workers per retiree. You have to change the ratio or fixes won’t last.