In October 2012, I turned 62 years old and had just been fired from my job. The last few years were hell. My bosses had done everything that they could to make my life miserable and get me to quit. I refused to quit because I was told by experts that I should work until I was 67, close to my regular retirement age to get full Social Security benefits. Well on my 62nd birthday- of all days- I was formally fired.

One side of me wanted to get right back on the rat race but another said it was time to call it a day and a career and retire and go on Social Security. (Early benefits at age 62) My friends and financial planner kept telling me that if I waited until 67 (or 70) I could get more money. But I kept telling them I did not have enough savings to stop work and not collect Social Security. Assuming a 4% average annual withdrawal from my $700,000 in savings and investments, I would need to collect both Social Security and take the annual 4% withdrawals to pay my living expenses.

So after much thought, I decided to retire and start collecting benefits and do the annual withdrawals.

Now 5 years later, I have done significant analysis and have determined that I will have more money up to my late 80s because I started to collect SS benefits at age 62 vs waiting until I was 67 years old. Here are the details:

On a 60/40 Stock Bond portfolio my $700,000 nest egg in October 2012, the month I turned 62 and was fired, with annual 4% withdrawals is now worth $1,036,551 today.

IF I would have waited to collect SS until I was 67 and have pulled out an additional $1300 a month out of the $700K to cover the lost Social Security benefits, above and beyond the 4%, to cover my expenses, I would have $933,638.00 today. ($102,913.00 less)

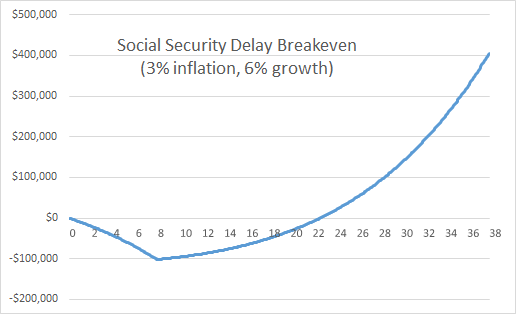

Yes, I would be getting $600 a month more in SS if I waited until I was 67 to collect. But it would take me 15 years to break even assuming no investment return from the additional $102,913. If I could get a 5% return going forward with my extra money, it would be 18 years before I broke even.

Yes, this all shows that unless you live well into your late 80s, it is better to collect your SS benefits at age 62 if you are not working.