for us it wasn’t take it and invest it ..it was a case of stopping the bleeding of our own invested dollars being used to support us .

on top of our normal draw we would take , we were fronting our selves the social security too we were not getting.

we were pulling out an extra 50k a year to compensate for the ss checks on top of the normal draw from our accounts .

at 65 we said enough of this and filed.

today our portfolio grew enough so our income is higher at 71 now then had we delayed to70-and continued pulling out the money we weren’t .

for us if worked out well but other outcomes it may not .it can take up to age 90 for delaying ss to equal a 5% real return from a balanced portfolio

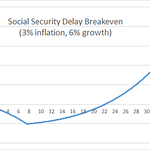

“ Since benefits not paid from 62 to 70 represents forgone investment opportunity, Mr. Kitces said it is critical to account for inflation, which he assumes to be 3%, and a time-value-of-money factor, which he assumes is 6% based on a balanced portfolio rate of return.

Using those assumptions, he calculates it would take 22 years to recover from the decision to delay collecting $750 per month in Social Security benefits. But beyond 84, the decision to delay Social Security continues to accrue exponentially, not just in the form of the higher delayed benefits but continuing cost-of-living adjustments.

Mr. Kitces noted the break-even point is sensitive to the return assumption used — the higher the rate of return, the longer the break-even period. Conversely, with more conservative return assumptions, the break-even point is reached more quickly.

“Those who reach age 90 (which would be the 28th year after delaying) have generated the equivalent of a 5% real rate of return in what is essentially a government-backed bond,” he wrote.

The payments produced by Social Security also dominate the nominal or real payments available from a comparable fixed or inflation-adjusted annuity, Mr. Kitces added. “This appears due primarily to the assumptions that are embedded in the Social Security formulas and benefits, many of which were built when longevity was shorter and interest rates were higher,” he explained.

Mr. Kitces concluded that the decision to delay Social Security is far superior to any risk-adjusted returns that can be achieved over comparable periods by the available alternatives, including risk-free bonds, growth-oriented equities or annuities.

“Ultimately, the decision to delay Social Security delivers the best results when there is either unexpected inflation, unusually long longevity or especially bad market returns, which are the exact three scenarios that traditional portfolios are the least effective at managing,” he wrote.

“Making the decision to delay Social Security,” Mr. Kitces wrote, “is the ultimate form of ‘anti-fragile’ triple hedge.”

https://www.investmentnews.com/reti...itces argued that delaying Social,Kitces said.