JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,702

So, in order to Blow That Dough, I bought both H&R Block and TurboTax Deluxe versions this year. Why? Why not? I wanted to see what the current state of each is in 2021. Plus it is cold and rainy, and I needed to type something.

Cost, Windoze version, both on Amazon:

- $23 : H&R Block Deluxe Download, black Friday week sale

- $30 : TurboTax Deluxe Download, Dec 26 special, includes $10 coupon presented by Amazon

Overall Impressions:

Both get you there if your return has simple to medium complexity. Each gets you there slightly differently, yet both follow the same Income-Deduction-Taxes-Other-File pattern. Both surprisingly had minor bugs. Both show your status in real time, per entry. In the end, both produced the same number for me for both Federal and State, after a little bit of pain. I preferred TT, but I could live with HRB if I had to.

Supported Forms and Situations:

Both supported some of the forms we've talked about with no problem:

- 1099-B

- 1099-OID

- 1099-R

- Roth conversions prompted while entering 1099-R

TurboTax pings you when you enter a 1099-B, suggesting you give them more money for Premium. In my opinion (and others here confirm) it is not required for retirees. If you have ESPP, NQSO, or ISO situations, Premium helps. Apparently, if you have no clue on your basis, it might help too.

Winners and Losers (Joe's Opinion):

- H&R Block: cost. Clearly the price leader.

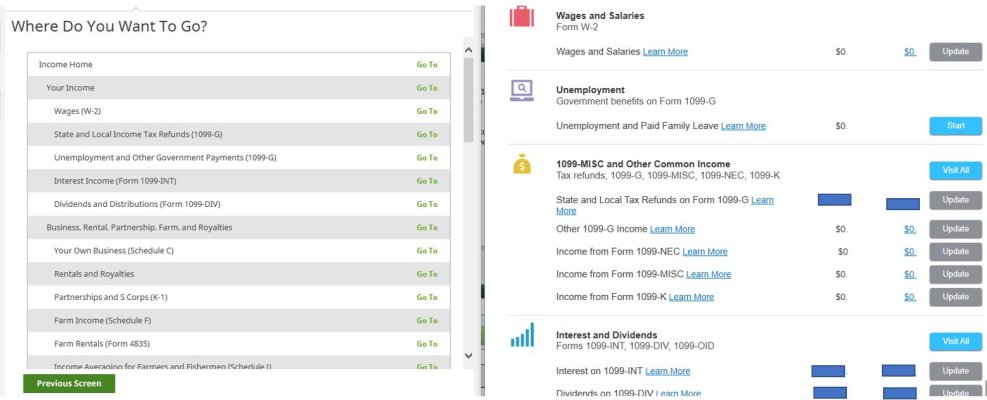

- Tie: Overall flow and choice between summary and direct interview. Both allow you to linearly flow through topics, or go to specific ones. TT might have a slight edge, but it is pretty much a tie.

- TurboTax: Summary screens for each category showing year-to-year comparison. HRB lacks this. It really helps to have Y-to-Y numbers of each topic if you are choosing topics. To me, this makes TT worth it.

- H&R Block: Forms. HRB allows you to pop out to look at forms while your interview question is still viewable. TT forces a context switch. You might want to get Sengsational's "draft cleanup" tool for printing, though.

- H&R Block: speed. The program starts faster and operates faster. TT is bloated.

- TurboTax: Exceptions handled better or more descriptions. I'm talking about situations like adjustments, or more than box A or D checked on 1099-B. HRB left more leg-work open to you. I also encountered a bug in this area on HRB (more later). TT's descriptions make more sense. HRB's venture into shop-talk and use some negative logic. More confusing.

I also found the 1099-B info easier to enter on TT, with more descriptions of how to handle Box E (non-covered) situations.

General Impressions:

HRB is down to business and follows a spare, clean style familiar to older windows programs. It also uses pop out windows which I like, some may not. TurboTax is prettier and flashier. It throws up useless "progress meters" that are all fluff and BS. Just show it to me already. I know on Premium it also has dancing bears -- OK, not quite. It has pretty pictures of Enrolled Agents to keep you motivated and to remind you part of the cost allows you a consultation of some sort. I don't see those folks on Deluxe.

HRB also does updates on a schedule. I think one of my bugs was fixed in the day I worked it, and until last night HRB had a bunch of warnings showing that updates were needed, come back when they are done! It did not give me confidence. TT updates whenever it feels like it. Both are still a little shaky if you ask me. I get wanting to file right away, but I'm going to give it a bit more time.

Bugs:

I started my taxes yesterday morning. HRB said an update was due on 2/18, which was yesterday. I didn't get it in the morning. On a 1099-INT from Treasury Direct, I had box 12 filled in. I believe this comes from a TIP. HRB let me enter it and had no further comment except for checkboxes on adjustments. TT let me enter it and presents similar checkboxes. I move on. When I finished both taxes, they were different by a few dollars. I noticed TT did an automatic ABP adjustment for the Box 12 info. HRB had "ABP" denoted, but at 0 dollars. I tried writing over the information in the 1099-INT entry, but nothing worked. I went to dinner, came back, and HRB wanted to update the program. I let it do so. ABP was still zero. I finally deleted the 1099-INT and reentered. At this time, I got an extra question, slightly confusing, asking me if I wanted to apply a bond premium adjustment. So, I gave it the box 12 info which is a bond premium, essentially negative interest. Boom, ABP was now in line with TT and everything was the same. Now I'm not saying that HRB is wrong to force you to enter the premium -- it basically makes you acknowledge it isn't amortized into the interest. What I'm saying is I couldn't even do that until they updated the program. So, apparently I saw a bug in progress that got fixed.

TT still has a bug which was almost as maddening. It is on my state tax form. It gets confused if you donate to our wildlife fund a portion of your refund, and ask for all of your refund to be applied to next year. It takes this info, then fails on final check. It then complains about my Breast Cancer donation being negative. Wait, I did the Wildlife check box, not the Breast Cancer checkbox! It is all confused, and surprised it didn't crash. I had to back it all out and not take the "apply entire refund," but instead apply an amount that still leaves enough for me to to make the donation. HRB, however, handled it without comment. It didn't create an impossible situation with forced negative numbers, it just silently rejected the extra donation if you apply the refund elsewhere.

Why I'm Staying With TurboTax:

So I think HRB is perfectly usable, especially on simple forms without nonsense like ABP adjustments for TIPS. It is also a breeze if you have 100% covered securities on your 1099-B. I just found TT to handle the ABP better, and I found entering the 1099-B easier on TT.

That aside, the $7 extra is worth it simply for the summary pages during entry which show the number from last year, and your current year running number. Super, super useful.

Otherwise, it is mostly a wash.

Cost, Windoze version, both on Amazon:

- $23 : H&R Block Deluxe Download, black Friday week sale

- $30 : TurboTax Deluxe Download, Dec 26 special, includes $10 coupon presented by Amazon

Overall Impressions:

Both get you there if your return has simple to medium complexity. Each gets you there slightly differently, yet both follow the same Income-Deduction-Taxes-Other-File pattern. Both surprisingly had minor bugs. Both show your status in real time, per entry. In the end, both produced the same number for me for both Federal and State, after a little bit of pain. I preferred TT, but I could live with HRB if I had to.

Supported Forms and Situations:

Both supported some of the forms we've talked about with no problem:

- 1099-B

- 1099-OID

- 1099-R

- Roth conversions prompted while entering 1099-R

TurboTax pings you when you enter a 1099-B, suggesting you give them more money for Premium. In my opinion (and others here confirm) it is not required for retirees. If you have ESPP, NQSO, or ISO situations, Premium helps. Apparently, if you have no clue on your basis, it might help too.

Winners and Losers (Joe's Opinion):

- H&R Block: cost. Clearly the price leader.

- Tie: Overall flow and choice between summary and direct interview. Both allow you to linearly flow through topics, or go to specific ones. TT might have a slight edge, but it is pretty much a tie.

- TurboTax: Summary screens for each category showing year-to-year comparison. HRB lacks this. It really helps to have Y-to-Y numbers of each topic if you are choosing topics. To me, this makes TT worth it.

- H&R Block: Forms. HRB allows you to pop out to look at forms while your interview question is still viewable. TT forces a context switch. You might want to get Sengsational's "draft cleanup" tool for printing, though.

- H&R Block: speed. The program starts faster and operates faster. TT is bloated.

- TurboTax: Exceptions handled better or more descriptions. I'm talking about situations like adjustments, or more than box A or D checked on 1099-B. HRB left more leg-work open to you. I also encountered a bug in this area on HRB (more later). TT's descriptions make more sense. HRB's venture into shop-talk and use some negative logic. More confusing.

I also found the 1099-B info easier to enter on TT, with more descriptions of how to handle Box E (non-covered) situations.

General Impressions:

HRB is down to business and follows a spare, clean style familiar to older windows programs. It also uses pop out windows which I like, some may not. TurboTax is prettier and flashier. It throws up useless "progress meters" that are all fluff and BS. Just show it to me already. I know on Premium it also has dancing bears -- OK, not quite. It has pretty pictures of Enrolled Agents to keep you motivated and to remind you part of the cost allows you a consultation of some sort. I don't see those folks on Deluxe.

HRB also does updates on a schedule. I think one of my bugs was fixed in the day I worked it, and until last night HRB had a bunch of warnings showing that updates were needed, come back when they are done! It did not give me confidence. TT updates whenever it feels like it. Both are still a little shaky if you ask me. I get wanting to file right away, but I'm going to give it a bit more time.

Bugs:

I started my taxes yesterday morning. HRB said an update was due on 2/18, which was yesterday. I didn't get it in the morning. On a 1099-INT from Treasury Direct, I had box 12 filled in. I believe this comes from a TIP. HRB let me enter it and had no further comment except for checkboxes on adjustments. TT let me enter it and presents similar checkboxes. I move on. When I finished both taxes, they were different by a few dollars. I noticed TT did an automatic ABP adjustment for the Box 12 info. HRB had "ABP" denoted, but at 0 dollars. I tried writing over the information in the 1099-INT entry, but nothing worked. I went to dinner, came back, and HRB wanted to update the program. I let it do so. ABP was still zero. I finally deleted the 1099-INT and reentered. At this time, I got an extra question, slightly confusing, asking me if I wanted to apply a bond premium adjustment. So, I gave it the box 12 info which is a bond premium, essentially negative interest. Boom, ABP was now in line with TT and everything was the same. Now I'm not saying that HRB is wrong to force you to enter the premium -- it basically makes you acknowledge it isn't amortized into the interest. What I'm saying is I couldn't even do that until they updated the program. So, apparently I saw a bug in progress that got fixed.

TT still has a bug which was almost as maddening. It is on my state tax form. It gets confused if you donate to our wildlife fund a portion of your refund, and ask for all of your refund to be applied to next year. It takes this info, then fails on final check. It then complains about my Breast Cancer donation being negative. Wait, I did the Wildlife check box, not the Breast Cancer checkbox! It is all confused, and surprised it didn't crash. I had to back it all out and not take the "apply entire refund," but instead apply an amount that still leaves enough for me to to make the donation. HRB, however, handled it without comment. It didn't create an impossible situation with forced negative numbers, it just silently rejected the extra donation if you apply the refund elsewhere.

Why I'm Staying With TurboTax:

So I think HRB is perfectly usable, especially on simple forms without nonsense like ABP adjustments for TIPS. It is also a breeze if you have 100% covered securities on your 1099-B. I just found TT to handle the ABP better, and I found entering the 1099-B easier on TT.

That aside, the $7 extra is worth it simply for the summary pages during entry which show the number from last year, and your current year running number. Super, super useful.

Otherwise, it is mostly a wash.

Last edited: