Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

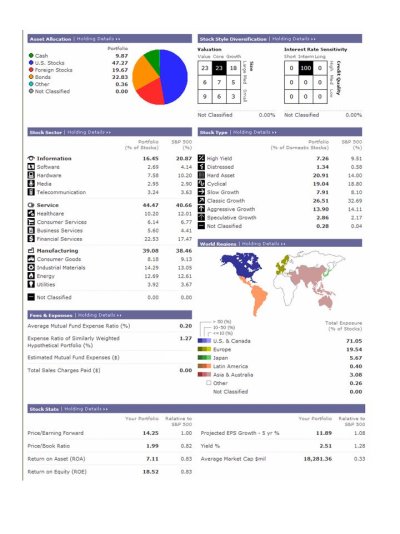

I'm 54, we're DINKs and essentially FI, but I intend to keep working until I can't stand it anymore probably 4-7 more years. I have always been somewhat aggressive/comfortable with risk, 100% in equities well into my 40's but sold the last of my individual equities 4-5 years ago, all funds now. The Four Pillars of Investing has been the most dominant influence on me since it was written. Thought I'd put my actual asset allocation % out there to see what comments it might generate. Hopefully I am providing enough info. It's highly unlikely I am going to radically alter my holdings but I am about to do some tweaking (too much in cash) so thought provoking comments would be welcome/interesting. TIA.

11.5% Van Tot Stk Mkt (Lg Blend - taxable account)

6.4% Van Tax Mgd Cap Appr (Lg Blend - taxable)

6.1% Van Gro & Inc (Lg Blend - taxable

7.0% Dodge & Cox Stk (Lg Val - taxable)

8.7% Van Tax Mgd Small Cap (Sm Blend -taxable)

5.0% Van Small Cap Val (Sm Val -sheltered)

15.1% Van Tax Mgd Intl (Foreign - taxable)

2.3% Van Tot Intl (Foreign - taxable)

23.3% Prudential Core Bond Indx (401k, only choice I have - sheltered)

2.9% Van REIT (sheltered)

2.7% Van Energy Fund (Sector, Commodity - sheltered)

9.0% Money Market (mostly taxable)

Probably not a factor but to the 100% above, we also have another 20%+ in tangible assets, mostly our home which we own outright.

11.5% Van Tot Stk Mkt (Lg Blend - taxable account)

6.4% Van Tax Mgd Cap Appr (Lg Blend - taxable)

6.1% Van Gro & Inc (Lg Blend - taxable

7.0% Dodge & Cox Stk (Lg Val - taxable)

8.7% Van Tax Mgd Small Cap (Sm Blend -taxable)

5.0% Van Small Cap Val (Sm Val -sheltered)

15.1% Van Tax Mgd Intl (Foreign - taxable)

2.3% Van Tot Intl (Foreign - taxable)

23.3% Prudential Core Bond Indx (401k, only choice I have - sheltered)

2.9% Van REIT (sheltered)

2.7% Van Energy Fund (Sector, Commodity - sheltered)

9.0% Money Market (mostly taxable)

Probably not a factor but to the 100% above, we also have another 20%+ in tangible assets, mostly our home which we own outright.

Last edited: