Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

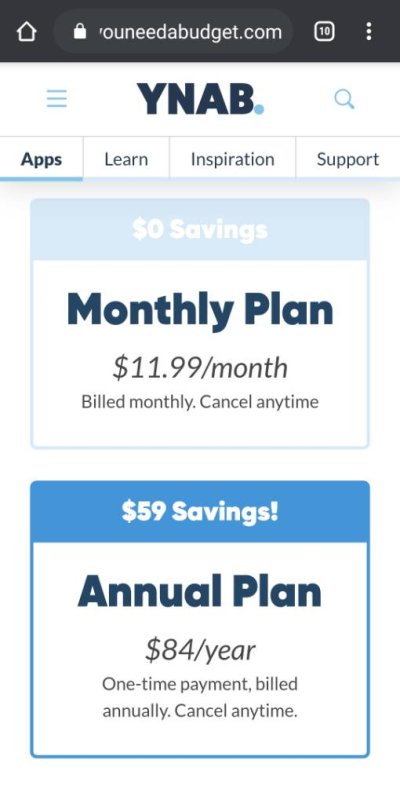

Most of us seem to use some sort of financial system, whether spreadsheets or personal finance software, to keep track of personal business and investments. Our 28 year old son's finances have become interesting enough that I think he would benefit from such a system, and he has expressed a desire to get more organized.

I have used Quicken for a few decades. It was not my first choice (my preferred software, MoneyCounts, was bought out years ago by Intuit or Microsoft Money or some competitor).

I am thinking of nudging our son toward some sort of financial system. Naturally I would lean toward Quicken because of its longevity and comprehensiveness. I know for some of us it is a love-hate thing.

It seems to me that one of our greatest legacies can be to help our kids learn good financial habits and stay organized. My mother, who was not a financial person, used an old school accounting system that her CPA helped her choose, in order to keep track of her rental properties. I remember helping her with it myself, sitting in front of her Leading Edge Model D.

Personal finance software has made this all so much more accessible and inexpensive.

What do your kids use, if anything, and how have you guided them?

I have used Quicken for a few decades. It was not my first choice (my preferred software, MoneyCounts, was bought out years ago by Intuit or Microsoft Money or some competitor).

I am thinking of nudging our son toward some sort of financial system. Naturally I would lean toward Quicken because of its longevity and comprehensiveness. I know for some of us it is a love-hate thing.

It seems to me that one of our greatest legacies can be to help our kids learn good financial habits and stay organized. My mother, who was not a financial person, used an old school accounting system that her CPA helped her choose, in order to keep track of her rental properties. I remember helping her with it myself, sitting in front of her Leading Edge Model D.

Personal finance software has made this all so much more accessible and inexpensive.

What do your kids use, if anything, and how have you guided them?