I am filing as a single and get ACA, so my ACA income limit is $40,000. The 12% bracket seems to be about $40,050 or so. This affects me since under that limit my LTCG tax rate is 0%.

I got myself into sort of a pickle when I sold some old "non-covered" mutual funds and discovered that they separate the basis between "non-covered" and "covered", so I created an unexpectedly large LTCG.

I have some short term investments that I might want to sell at a gain because they are speculative and might have a sudden price drop, but I am trying to assess the impact of going over my limits.

I just ran a "play" Turbo Tax scenario and it seems to confirm the following assumptions, but I wanted to double check by asking here.

1. The standard deduction does not get subtracted from the AGI calculation, so any income over my $40,000 ACA limit is going to reduce my subsidy. I am guessing that this will add 8% to my tax amount for the over the limit gains.

2. The standard deduction does get subtracted from the taxable income, so my actual limit for the 0% LTCG rate is not just $40,050 of income, but $40,050 plus the standard deduction amount.

3. Interest and short term gains are counted first and will push the LTCG up over the limit if the STCG are too much.

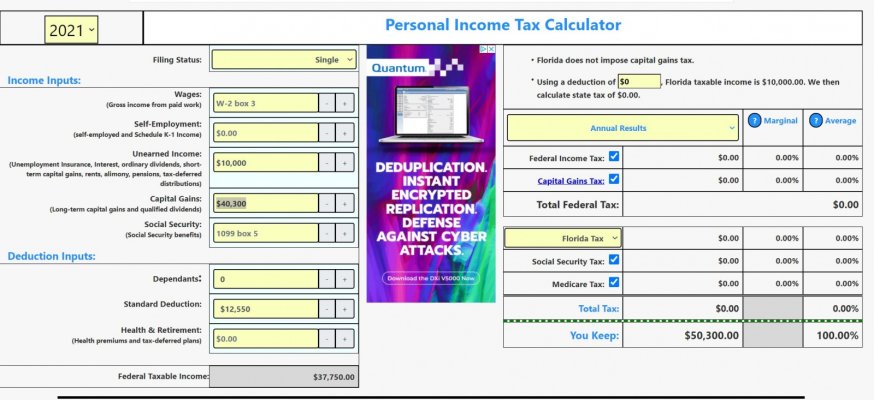

I ran the quick and dirty Turbo Tax scenario as follows and it gave me $0 taxes owed:

Interest $10,000

Short term capital gain $10,300

Short term capital loss ($7950)

Long term capital gain $37950

So it seems to let me have roughly $50,300 of income, which seems close to the $40,050 12% limit plus the standard deduction. I probably had some other carry over stuff that might have effected it a little bit, since it copied from my actual return for 2019 but I don't think it would materially affect the result.

So, do my assumptions make sense and seem correct?

If so, it would seem I have another $10,000 or so of wiggle room to take some STCG.

Thanks.

Joe

I got myself into sort of a pickle when I sold some old "non-covered" mutual funds and discovered that they separate the basis between "non-covered" and "covered", so I created an unexpectedly large LTCG.

I have some short term investments that I might want to sell at a gain because they are speculative and might have a sudden price drop, but I am trying to assess the impact of going over my limits.

I just ran a "play" Turbo Tax scenario and it seems to confirm the following assumptions, but I wanted to double check by asking here.

1. The standard deduction does not get subtracted from the AGI calculation, so any income over my $40,000 ACA limit is going to reduce my subsidy. I am guessing that this will add 8% to my tax amount for the over the limit gains.

2. The standard deduction does get subtracted from the taxable income, so my actual limit for the 0% LTCG rate is not just $40,050 of income, but $40,050 plus the standard deduction amount.

3. Interest and short term gains are counted first and will push the LTCG up over the limit if the STCG are too much.

I ran the quick and dirty Turbo Tax scenario as follows and it gave me $0 taxes owed:

Interest $10,000

Short term capital gain $10,300

Short term capital loss ($7950)

Long term capital gain $37950

So it seems to let me have roughly $50,300 of income, which seems close to the $40,050 12% limit plus the standard deduction. I probably had some other carry over stuff that might have effected it a little bit, since it copied from my actual return for 2019 but I don't think it would materially affect the result.

So, do my assumptions make sense and seem correct?

If so, it would seem I have another $10,000 or so of wiggle room to take some STCG.

Thanks.

Joe