How would Fed Income tax be calculated if a married couple has $100k in total AGI income. Assume $75k are qualified dividends and $25k is interest. These two amounts would be taxed at different rates, but how does the standard deduction work into the calculation? Does the standard deduction ($27.7k) get subtracted from the $100k first? If so, how would the remaining amounts be taxed since they would be taxed at different rates? Just looking for basic info on how these calculations are made.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Basic? Income Tax calculation when considering standard deduction

- Thread starter Wupot2020

- Start date

latexman

Thinks s/he gets paid by the post

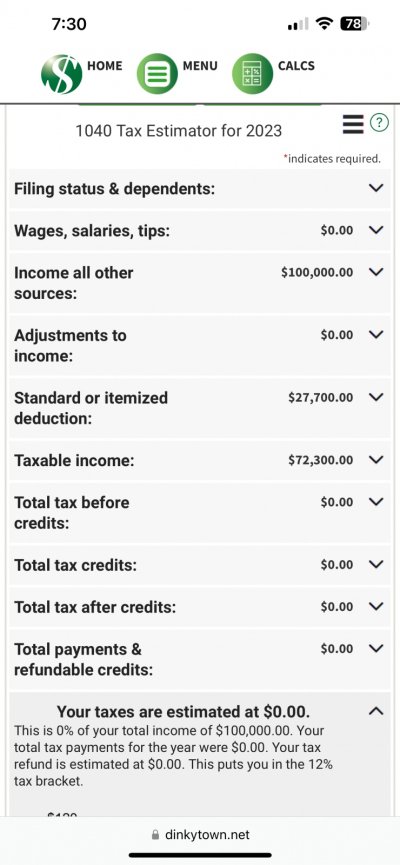

Standard deduction gets subtracted. No tax owed.

https://www.dinkytown.net/java/1040-tax-calculator.html#

https://www.dinkytown.net/java/1040-tax-calculator.html#

Attachments

Last edited:

Stack the income with the items taxed at ordinary rates first and the items taxed at long-term rates second. In your example, that would be $25K interest first, then $75K QDivs.

Use as much of the standard deduction as you can to cover the ordinary income, then use any remaining amount to cover the long-term income. So $25K of the standard deduction covers all of the interest and the other $2.7K covers part of the QDivs, leaving $72.3K of QDivs as the only income that will be taxed. All of that fits in the 0% long-term bracket for a couple filing MFJ, so they will not owe any tax.

Suppose instead that you had $40K of interest income. In that case $12.3K of interest would be taxed at 10%. Add the $75K QDivs and the total income is $87.3K which is still in the 0% bracket for long-term income. The total tax would be $1230.

Use as much of the standard deduction as you can to cover the ordinary income, then use any remaining amount to cover the long-term income. So $25K of the standard deduction covers all of the interest and the other $2.7K covers part of the QDivs, leaving $72.3K of QDivs as the only income that will be taxed. All of that fits in the 0% long-term bracket for a couple filing MFJ, so they will not owe any tax.

Suppose instead that you had $40K of interest income. In that case $12.3K of interest would be taxed at 10%. Add the $75K QDivs and the total income is $87.3K which is still in the 0% bracket for long-term income. The total tax would be $1230.

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

You can walk through the qualified dividends and capital gains worksheet to see all the steps.

Conceptually:

1. Income is totaled - ordinary income first, preferenced income on top.

2. Standard (or itemized deductions) is subtracted from the bottom.

3. Ordinary income brackets are applied to any remaining ordinary income.

4. Capital gains brackets are applied to any remaining preferenced income.

In your case:

1. $25K of ordinary income as interest, $75K of preferenced income as qualified dividends.

2. $27.7K standard deduction is subtracted off the bottom. This erases all of the interest income and the first $2.7K of qualified dividends, leaving $72.3K.

3. Not applicable in this scenario because there is none remaining.

4. The remaining $72.3K all falls into the 0% bracket, so there would be $0 in federal income tax.

If there were more qualified dividends, some of them would fall into the 15% bracket. Like ordinary income brackets, only the portion of the qualified dividends that fell into the 15% bracket would be taxed at that rate and would end up on line 18 of the worksheet.

Here's a web page that outlines the worksheet in detail and what happens on it generally: https://www.marottaonmoney.com/how-...lified-dividends-and-capital-gains-worksheet/

The couple would still have an AGI of $100K. AGI can affect things like state income taxes, ACA subsidies, and FAFSA. It also can affect eligibility for a large number of adjustments, deductions, and credits.

Conceptually:

1. Income is totaled - ordinary income first, preferenced income on top.

2. Standard (or itemized deductions) is subtracted from the bottom.

3. Ordinary income brackets are applied to any remaining ordinary income.

4. Capital gains brackets are applied to any remaining preferenced income.

In your case:

1. $25K of ordinary income as interest, $75K of preferenced income as qualified dividends.

2. $27.7K standard deduction is subtracted off the bottom. This erases all of the interest income and the first $2.7K of qualified dividends, leaving $72.3K.

3. Not applicable in this scenario because there is none remaining.

4. The remaining $72.3K all falls into the 0% bracket, so there would be $0 in federal income tax.

If there were more qualified dividends, some of them would fall into the 15% bracket. Like ordinary income brackets, only the portion of the qualified dividends that fell into the 15% bracket would be taxed at that rate and would end up on line 18 of the worksheet.

Here's a web page that outlines the worksheet in detail and what happens on it generally: https://www.marottaonmoney.com/how-...lified-dividends-and-capital-gains-worksheet/

The couple would still have an AGI of $100K. AGI can affect things like state income taxes, ACA subsidies, and FAFSA. It also can affect eligibility for a large number of adjustments, deductions, and credits.

I use this calculator:

https://www.irscalculators.com/tax-calculator

is there any advantage to this one compared to dinkytown?

https://www.irscalculators.com/tax-calculator

is there any advantage to this one compared to dinkytown?

jollystomper

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 16, 2012

- Messages

- 6,188

I use this calculator:

https://www.irscalculators.com/tax-calculator

is there any advantage to this one compared to dinkytown?

The dinkytown calculator appears to have more line items to separate the input. For example, the calculator you link to has one line item that encompasses all unearned income (unemployment Insurance, Interest, ordinary dividends, short-term capital gains, rents, alimony, pensions, tax-deferred distributions), while dinkytown provides a separate line item entry for each of these.

How would Fed Income tax be calculated if a married couple has $100k in total AGI income. Assume $75k are qualified dividends and $25k is interest. These two amounts would be taxed at different rates, but how does the standard deduction work into the calculation? Does the standard deduction ($27.7k) get subtracted from the $100k first? If so, how would the remaining amounts be taxed since they would be taxed at different rates? Just looking for basic info on how these calculations are made.

Here's a simple calculator that shows things graphically:

https://engaging-data.com/tax-brackets/?fs=1®=25000&cg=75000&yr=2023

FiveDriver

Full time employment: Posting here.

Here's a simple calculator that shows things graphically:

https://engaging-data.com/tax-brackets/?fs=1®=25000&cg=75000&yr=2023

While the 'visualizer' is an interesting concept, I didn't notice a bump for MFJ both over 65. Or a line item for Interest Income & Dividends.

Capital Loss Harvesting seems to be listed as a negative Gap Gain.

It's a good idea, though.

Similar threads

- Replies

- 8

- Views

- 640

- Replies

- 0

- Views

- 218