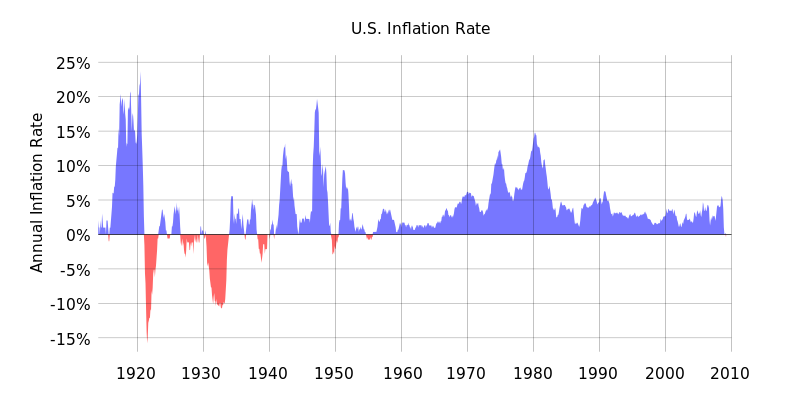

Quantitative easing may cause higher inflation than desired if the amount of easing required is overestimated, and too much money is created. On the other hand, it can fail if banks remain reluctant to lend money to small business and households in order to spur demand. Quantitative easing can effectively ease the process of deleveraging as it lowers yields. But in the context of a global economy, lower interest rates may contribute to asset bubbles in other economies.

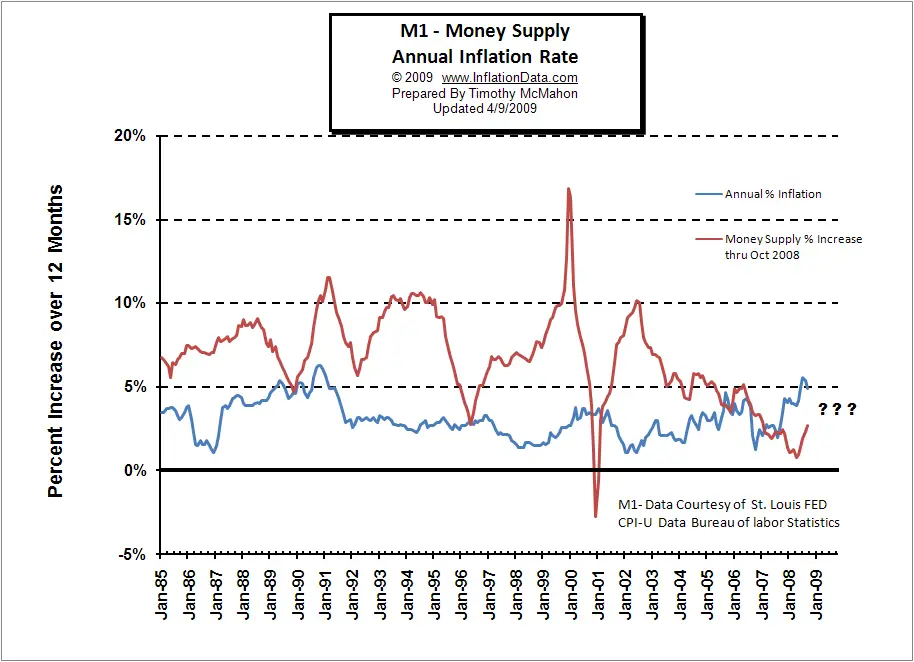

An increase in money supply has an inflationary effect (as indicated by an increase in the annual rate of inflation). There is a time lag between money growth and inflation, inflationary pressures associated with money growth from QE could build before the central bank acts to counter them. Inflationary risks are mitigated if the system's economy outgrows the pace of the increase of the money supply from the easing. If production in an economy increases because of the increased money supply, the value of a unit of currency may also increase, even though there is more currency available. For example, if a nation's economy were to spur a significant increase in output at a rate at least as high as the amount of debt monetized, the inflationary pressures would be equalized. This can only happen if member banks actually lend the excess money out instead of hoarding the extra cash. During times of high economic output, the central bank always has the option of restoring the reserves back to higher levels through raising of interest rates or other means, effectively reversing the easing steps taken.