Here is a another wrinkle in how many brokerages to keep positions, especially Vanguard and Fido

I got a call from my Fido Private Client Advisor today advising me that Fido was offering some significant bucks for positions transfers from other brokerages. She knows from my Full View that we have some funds with Vanguard. We have about 25% of our positions at Vanguard.

If you move positions worth 1 Million or larger, you get 2500 added to your account. 500k will get you $1250. They will take any amounts--just lower $$ for the move.

My impression is that you do not change any of your positions, they get moved directly to Fido, so no loss of Vanguard positions or expense benefits.

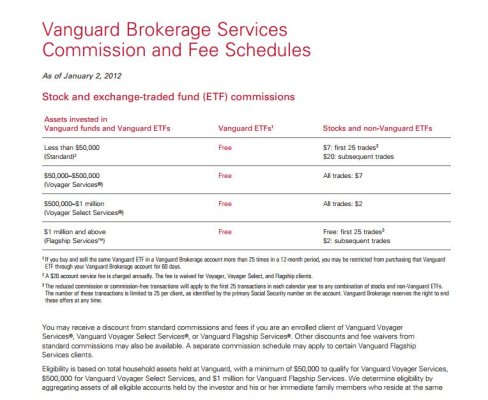

So here is the question. Given a strategy that emphasizes ETFs (can buy any Vanguard ETFs for $8--same as any other sponsor except I-shares which many are free at Fido), is there a good reason not to take up Fido on their offer?

Nwsteve

I got a call from my Fido Private Client Advisor today advising me that Fido was offering some significant bucks for positions transfers from other brokerages. She knows from my Full View that we have some funds with Vanguard. We have about 25% of our positions at Vanguard.

If you move positions worth 1 Million or larger, you get 2500 added to your account. 500k will get you $1250. They will take any amounts--just lower $$ for the move.

My impression is that you do not change any of your positions, they get moved directly to Fido, so no loss of Vanguard positions or expense benefits.

So here is the question. Given a strategy that emphasizes ETFs (can buy any Vanguard ETFs for $8--same as any other sponsor except I-shares which many are free at Fido), is there a good reason not to take up Fido on their offer?

Nwsteve