ncbound

Confused about dryer sheets

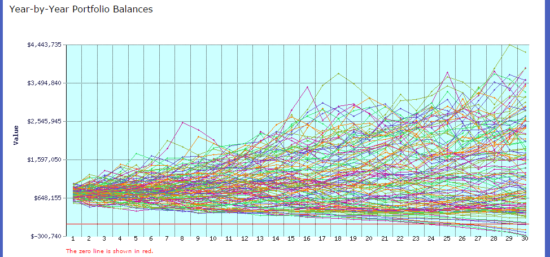

I discovered Firecalc a few weeks ago and have been obsessed with crunching numbers. I'm planning on retiring in 2 years at age 55. For those that have been retired for a while - I was wondering how your Firecalc results compare to real life. Thanks.