Rosie

Recycles dryer sheets

Hi, I was running some scenarios on Firecalc and I found an error in the results report.

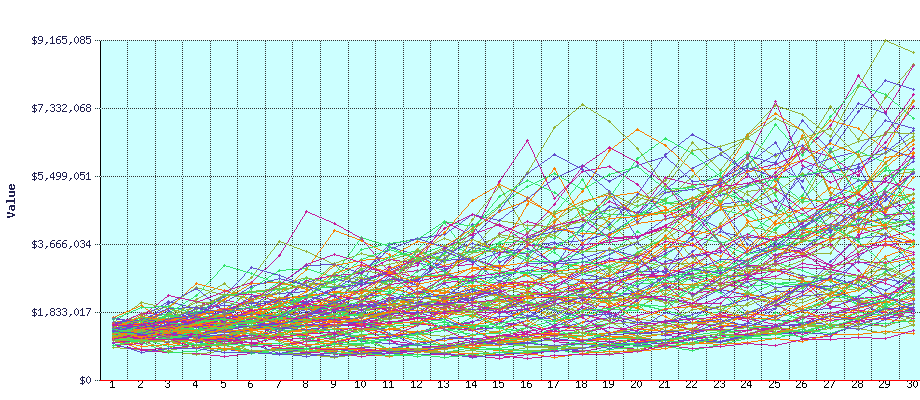

Whenever I do a run where the lowest portfolio balance at the end of 30 years is larger than the starting portfolio balance, the written "Here is how your portfolio would have fared" section always just brings back the starting portfolio balance as the lowest balance at the end of 30 years, even though the graph shows a much larger final balance.

For example, using only the Firecalc default values and varying the starting portfolio amounts, here's what I see:

Spending: 30000

Portfolio: (varies)

Full Years: 30

750,000 (default): The lowest and highest portfolio balance at the end of your retirement was $-300,739 to $4,259,606, with an average at the end of $1,421,948.

1,000,000: The lowest and highest portfolio balance at the end of your retirement was $546,203 to $6,585,050, with an average at the end of $2,713,579.

1,500,000: The lowest and highest portfolio balance at the end of your retirement was $1,500,000 to $11,235,937, with an average at the end of $5,296,843. (The lowest 30-yr balance shown on the graph appears close to 2.2 million.)

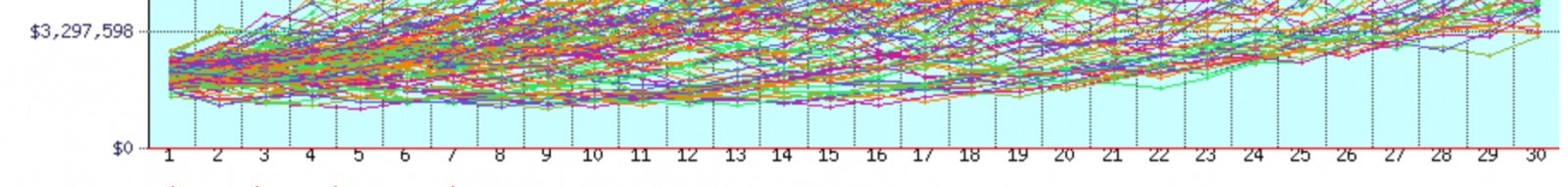

2,000,000: The lowest and highest portfolio balance at the end of your retirement was $2,000,000 to $15,886,825, with an average at the end of $7,880,107. (The lowest 30-yr balance shown on the graph appears close to 3.3 million.)

When the lowest 30-year balance is less than the starting portfolio balance, the numerical value agrees with what's shown on the graph. It only seems to be an issue when the lowest final balance is greater than the starting balance.

I wonder if this glitch also affects the average ending balance? That's a number I like to compare when I'm running different scenarios.

Whenever I do a run where the lowest portfolio balance at the end of 30 years is larger than the starting portfolio balance, the written "Here is how your portfolio would have fared" section always just brings back the starting portfolio balance as the lowest balance at the end of 30 years, even though the graph shows a much larger final balance.

For example, using only the Firecalc default values and varying the starting portfolio amounts, here's what I see:

Spending: 30000

Portfolio: (varies)

Full Years: 30

750,000 (default): The lowest and highest portfolio balance at the end of your retirement was $-300,739 to $4,259,606, with an average at the end of $1,421,948.

1,000,000: The lowest and highest portfolio balance at the end of your retirement was $546,203 to $6,585,050, with an average at the end of $2,713,579.

1,500,000: The lowest and highest portfolio balance at the end of your retirement was $1,500,000 to $11,235,937, with an average at the end of $5,296,843. (The lowest 30-yr balance shown on the graph appears close to 2.2 million.)

2,000,000: The lowest and highest portfolio balance at the end of your retirement was $2,000,000 to $15,886,825, with an average at the end of $7,880,107. (The lowest 30-yr balance shown on the graph appears close to 3.3 million.)

When the lowest 30-year balance is less than the starting portfolio balance, the numerical value agrees with what's shown on the graph. It only seems to be an issue when the lowest final balance is greater than the starting balance.

I wonder if this glitch also affects the average ending balance? That's a number I like to compare when I'm running different scenarios.