target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

That is so simple. Thank you for answering.It is an investment that produces income and returns to a predetermined fixed amount at maturity.

That is so simple. Thank you for answering.It is an investment that produces income and returns to a predetermined fixed amount at maturity.

So it’s all about matching ones personal needs and goals to their own appropriate investing style.

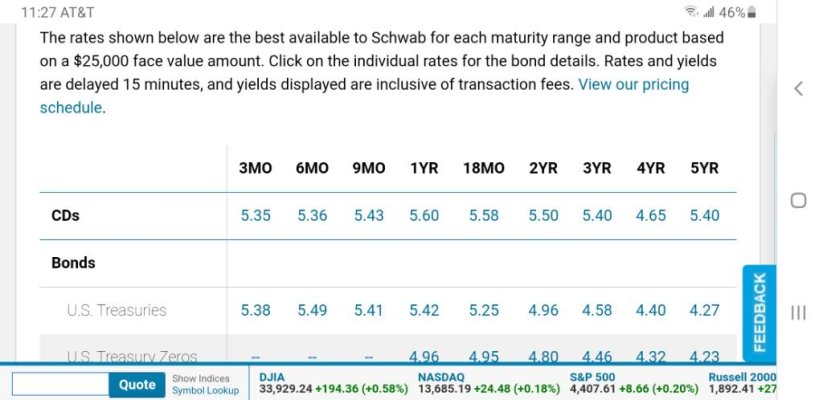

They still are issuing noncallable 5 year CDs. They just arent at the yield people had a shot at a few months back. Discover Bank and United Fidelity Bank presently have 5 year noncallables for sale with coupon yields of 4.45% and 4.5%.

+1

This is my main objection to the proliferation of posts praising market timing over the last 15 months.

Lots of smiles are gonna turn to frowns in the next couple years.

Yes true, but an inverted yield curve and high uncertainty about whether inflation is under control, does give a bit of pause on filling out the far end of the ladder, unless its with TIPS. A duration bond of 10 years likely has a maturity date of much longer than 10, and if rates do spike it would be pretty painful, until or unless they settle back down over the coming several years.

With my ladders, I balance trying to get the best yield with having reliable income - the whole purpose of my ladder. I may give up a little in yield by going longer or with non call or longer call window bonds, but in return I get income I know is going to be there. So reinvestment risk, while there with any maturing bond, does not hurt me as much. I am almost equally balanced between short, intermediate and long bonds with a few percentage point leaning to short. All investment grade. The ladder throws off almost 145% of our spending needs. Equities remain untouched and may stay that way forever.

Good call- maybe. I am going out 5 years when I can 4.5 - 4.84 CD's. I know I can get 5% or better for a 2 year. but don't want a bunch if money coming due as rates drop. All my CD's are paying at least a1 point higher then the one maturing. Which is equal to 20-30% more return. I am OK with 4.5% I am combining maturing CD's as they come due.

Mulligan,

You made some interesting comments some time ago about utility debt. Don't let me misquote you but it was something to the effect that you find lower rated utility debt interesting because defaults are so rare with utilities? Because they are essential infrastructure and regulated perhaps?

Painful in what way? Mark to market price? It’s meaningless if you hold to maturity. So if income is your desire, it’s mine, make sure you are buying good coupons because if your 6% $100 bond goes to $50 for awhile before returning to par, you still get paid that nice 6% coupon. You should also have your rungs maturing to take advantage of higher yields - if they even happen.

COcheesehead, any chance of getting your equities asset allocation? If it's complicated or you do not wish to share no problem. I just like your thought process on the fixed income side and imagine it would likely be similar on the equities side. Something I'm struggling with currently (thinking 60% SPY/SCHD and 40% Wellington and Wellesley for simplicity).

I’ve said this before. Don’t buy bonds for inflation protection. Buy for current income and capital preservation. I have other things that would benefit if inflation goes nuts, but right now the ladders overfund our retirement.I ran some numbers, and I think you're right that the odds of a problem are pretty unlikely.

The price up's and down's until maturity obviously don't matter. I'm thinking of the remote possibility where it becomes really difficult to get inflation under control over the coming years. Yearly spending has to go way up because of inflation, but those funds in long term bonds are locked in at way below market interest rates, leading to much lower coverage of expenses.

I ran scenarios yesterday with different inflation rates, spending coverage rates, and return rates, and unless inflation really spirals out of control in the next few years, the odds of this scenario happening are pretty low. And of course having a bond ladder limits the damage to a few years.

I’ve said this before. Don’t buy bonds for inflation protection. Buy for current income and capital preservation. I have other things that would benefit if inflation goes nuts, but right now the ladders overfund our retirement.

Reliable income is a priority for us. We have no pension, no social security and have no plans to start it for years yet.

I hear you. We have the same exact situation, and I've built an income stream that more than covers our expenses right now, by about 50%. What I'm trying to figure out is how to make sure the portfolio survives 30-35 years, and it seems like the only real exposure is high inflation.

For example, under a 5% inflation rate, a 40-50% income cushion might get eaten away by year 8-10, unless reinvestment rates on the bonds increases due to the inflation. Maybe/probably the rates would increase and there's no issue.

But for the sake of argument, let's just say inflation continues to run hot and rates don't increase in the coming years. That scenario is possible because of extreme government deficits. In that scenario, something in the portfolio via total returns and distributions needs to cover the gap, as you correctly point out. And, it needs to be a big enough percentage of the portfolio .

Moderator note: The topic of this thread is fixed income investing, not complaining about other threads. Please stay on topic.

I keep looking at municipals, both taxable and non taxable, and they never have a bid price, only ask. How in the world do you figure out what to bid? I like seeing bid prices as a check that the bond isn't a total turd.

Price isn’t the only determiner. Existing bids in many cases are low ball offers hoping the seller will bite. Fidelity provides third party pricing, you can read the latest ratings report and see the ratings. Trading in tax free munis is, was and likely always will be thin. Taxable munis on the short end almost always have a bid.

How do you figure out what to bid? Look at other bonds of similar duration. The buy yield needs to be relatively similar if you have any chance of getting it.

I keep looking at municipals, both taxable and non taxable, and they never have a bid price, only ask. How in the world do you figure out what to bid? I like seeing bid prices as a check that the bond isn't a total turd.

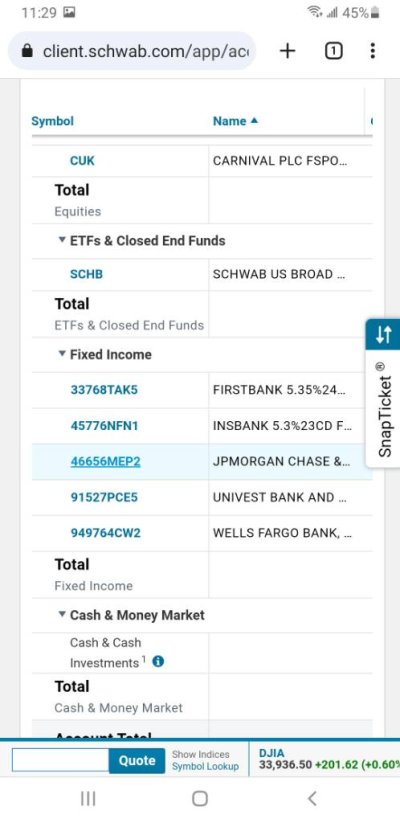

Did I make a mistake?? I did my 1st 'ladder' with 16% of portfolio last week with 5 rungs going out 18 months. All steps are 5.35% ex 3 month at 5.3% & 18 months at 5.5%. Today they'd all be fractionally higher .... 5.35-5.6% and 2 at the higher rate. Should I have just done another 30 day instead? View attachment 46474View attachment 46475

My idea is to move each into 2, 3, 4 yr ones when they come due. But I might be too late .... it might come too far down.

Please be gentle. I'm only used to equities. I thought CDs were just for saving and bonds scare me.

Got it.Rates change all the time. That’s why you ladder. You always have fresh funds to take advantage of rising rates. If rates drop, you have some invested at the higher rate as well.

My ladder goes out 9+ years. I don’t worry about yield, I am more concerned about total cashflow.