Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

https://personal.vanguard.com/us/insights/investingtruths

They are:

1) Goals - Create clear, appropriate investment goals.

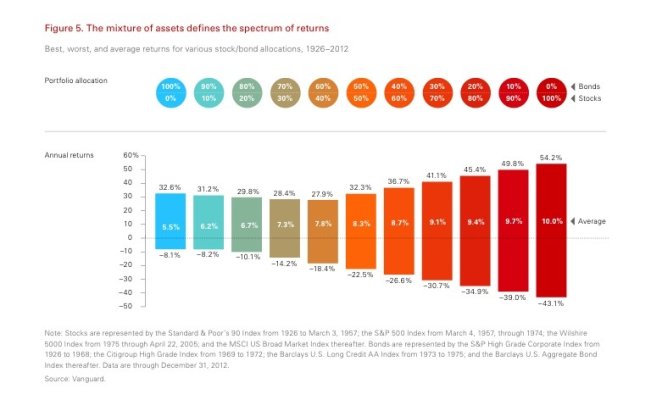

2) Balance - Develop a suitable asset allocation using broadly diversified funds.

3) Cost - Minimize cost.

4) Discipline - Maintain perspectiveand long-term discipline.

Nothing new to most here, but a good summary, and the PDF version is a pretty complete read. I would recommend it to newbies and novices, though it doesn't hurt for any of us to review and reinforce.

It's interesting to me how 1 thru 3 dominate discussion here and elsewhere, when 4 is where most people go off the tracks. I can't the last meaningful thread on how to keep your head when the market goes into spasms, as it always will. Too many people alternate between panic and greed or just decide they can outsmart the pros...1 thru 3 probably won't help if you don't have the discipline to go with the program. YMMV

They are:

1) Goals - Create clear, appropriate investment goals.

2) Balance - Develop a suitable asset allocation using broadly diversified funds.

3) Cost - Minimize cost.

4) Discipline - Maintain perspectiveand long-term discipline.

Nothing new to most here, but a good summary, and the PDF version is a pretty complete read. I would recommend it to newbies and novices, though it doesn't hurt for any of us to review and reinforce.

It's interesting to me how 1 thru 3 dominate discussion here and elsewhere, when 4 is where most people go off the tracks. I can't the last meaningful thread on how to keep your head when the market goes into spasms, as it always will. Too many people alternate between panic and greed or just decide they can outsmart the pros...1 thru 3 probably won't help if you don't have the discipline to go with the program. YMMV

Because investing evokes emotion, even sophisticated investors should arm themselves with a long-term perspective and a disciplined approach. Abandoning a planned investment strategy can be costly, and research has shown that some of the most significant derailers are behavioral: the failure to rebalance, the allure of market-timing, and the temptation to chase performance.

Far more dependable than the markets is a program of steady saving. Making regular contributions to a portfolio, and increasing them over time, can have a surprisingly powerful impact on long-term results.

Last edited: