ladelfina

Thinks s/he gets paid by the post

- Joined

- Oct 18, 2005

- Messages

- 2,713

found by way of:

naked capitalism

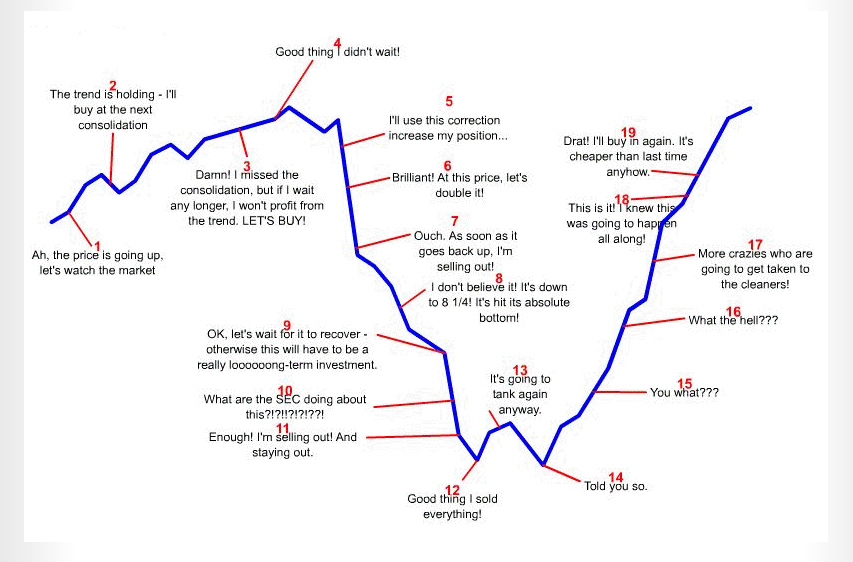

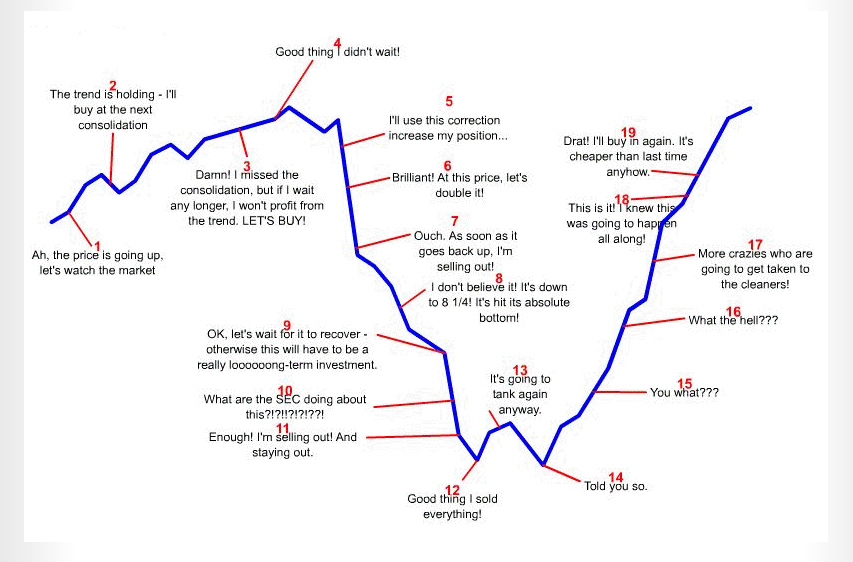

I don't think anyone who is honest with themselves has completely avoided having any of these reactions..

Very funny, and something I can personally relate to.

But, but, but, at this point in time, do you think we are at point #10 in the above graph, or at point #15?

Please help me, as I have no clue ... Maybe even point #6?

Ha meant we are at point 13. Which means in the long run, it's not a bad time to buy.