For married folks, the best deal is usually for the higher beneficiary spouse to take later, especially if the higher is also older. That way, when the older, higher dies first - as predicted, the remaining spouse collects that higher amount vs. their own lower amount.I am not understanding that Social Security site. I put in my SS benefit of 1678 and it says my annual benefit would be $15,000. Well-no- it would be $20,136.

Same for my husband's. I put in 2286 and it is saying his annual would be $36,210.

I am not working and he is.

It is saying I should take it now and he should take it at age 70.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Hiring a Financial Planner

- Thread starter meleana

- Start date

It is adjusting the PIAs that you input for taking SS early or late. $15,000 ~ 75% of $20,136 so that sounds about right... I assume that you are ~62?

For him, $36,210 is about 132% of his PIA of $27,432 which reflects 4 years of delayed retirement credits at 8% a year, so I'm guessing that he was born between 1943 and 1954.

Now note what the present value would be for the recommended strategy. Then at the very bottom, test alternative claiming strategies of both taking now, both taking at age 65, both taking at FRA (full retirement age) and then you taking at FRA and him at age 70 and note the present value associated with each alternative.

I'm guessing that the present values of the various alternatives are not all that different.

Wow! Thanks! You are on the money! I am 62 and my husband was born in 1954. He will either retire at 66 or 67. The issue is health insurance for me if he were to leave his job at 66, as I would just be turning 64 and not yet eligible for Medicare. But I could pay for retiree health benefits just on me if worse comes to worse- but expensive. But that's another story.

I will try a few more alternatives on that site. I don't really know what my benefits would be right now- I only have last year's statement- I was born in June- and I just quit work this past Sept.

And we don't know my husbands either- we are basing it on last years statement as well- because he just applied for Medicare Part A and so they did not put his statement for this year up yet. Why that matter- I don't get it as there is no premium for it)

So I could be making a mistake not taking my SS now? Wow. I thought the longer I waited the better it would be so as to get a higher check. I was originally thinking of waiting until 66 and 4 months- my FRA and hubby at 70- or both of us at 66.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

No, I don't think you are making a mistake at all. Once you look at the various alternatives you'll see that it doesn't make a lot of difference. I don't remember what the optimal solution was for us but we both plan on FRA for now... but I might wait to try to reduce our IRA some so our RMDs will be lower.

One year old SS statements are probably fine, but you can get updated ones directly from the SSA website.

For health insurance you can start with healthsherpa.com to get a idea what an ACA policy would cost for that gap year from 64 to 65.

One year old SS statements are probably fine, but you can get updated ones directly from the SSA website.

For health insurance you can start with healthsherpa.com to get a idea what an ACA policy would cost for that gap year from 64 to 65.

Last edited:

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Sometimes you ask for a drink, and get the firehose!Thanks. As I mentioned I already have free advice through T Rowe Price- but it is just regarding investments and asset allocation- not the holistic picture of the other factors we need to be concerned with in retirement, though they do give SOME input on that, of course.

I need help with how to tax efficiently draw down our money for income to live on and so forth. How can we afford to move? I am just a bit overwhelmed I guess.

.

There are plenty of drawdown spreadsheets out there. The better ones get mentioned over and over, so no problem in finding a few to get started with your plan.

What you may find is that even when you get a FP to do this, it may require tweaking each year. I think if you put some time into this, it will pay later, since you'll have accumulated some knowledge. Even if you pay a planner, having the knowledge helps you evaluate what a FP presents to you.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Said another way, a good financial planner is a teacher, not an oracle. Consider that when interviewing.... Even if you pay a planner, having the knowledge helps you evaluate what a FP presents to you.

- Joined

- Nov 27, 2014

- Messages

- 9,206

What you may find is that even when you get a FP to do this, it may require tweaking each year. I think if you put some time into this, it will pay later, since you'll have accumulated some knowledge. Even if you pay a planner, having the knowledge helps you evaluate what a FP presents to you.

This is what we found. The plan is for DW to take SS at FRA and me at 62. DW is 5 years older so we'll take SS at about the same time. This is contrary to common thought because I was the higher paid. But, when you hire a FP, they will help you see how taking SS impacts you're entire picture. With us, the way he planned for us to take SS makes sense given my pension and the plan for drawing down our 401K's/IRA's and all considered RMD's and taxes. For me, it was great to become educated and talk on this forum. It helped greatly with my discussion with the FP, but the FP had a better ability (models, knowledge . . .) to put it all together for me and DW. I totally agree the comments above about you being knowledgeable even if you hire someone.

No, I don't think you are making a mistake at all. Once you look at the various alternatives you'll see that it doesn't make a lot of difference. I don't remember what the optimal solution was for us but we both plan on FRA for now... but I might wai to try to reduce our IRA some so our RMDs will be lower.

One year old SS statements are probably fine, but you can get updated ones directly from the SSA website.

For health insurance you can start with healthsherpa.com to get a idea what an ACA policy would cost for that gap year from 64 to 65.

What I was saying is that I can't get the updated one yet for my husband because they are not on the SS website. For some reason when you apply for Medicare, SS does not make it available for awhile. Why I do not know.

Mine won't be updated yet as my birthday is in June- so 3 months before I should able to get it.

In terms of health insurance it would be expensive through the exchange- unless somehow our AGI would show as low- that is where i need an advisor or CPA.

I am estimating we need the same income as my husband brings in now- he makes $82,000 gross per year. I am figuring we need at least $60,000 net per year to meet expenses and have a little bit of a life.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

That might be about right.... his takehome pay would be a better indicator of what you spend than his gross pay. Have you put together a retirement expense budget to try to get a better handle on what your spending is/will be?

Last edited:

That might be about right.... his takehome pay would be a better indicator of what you spend than his gross pay. Hpave you put together a retirement expense budget to try to get a better handle on what your spending is/will be?

Yes. Thanks. We figure the budget will be about the same as now (I keep a budget on an excel sheet). Sure- the gas bill and tolls will come down once hubby stops working, but then I could have the health insurance premiums. We also plan to move and so that will involve extra expenses outside our budget.

Really- we don't foresee much difference in the budget now to then except medical stuff that could crop up.

rk911

Thinks s/he gets paid by the post

we used a fee only FP from a teferral from our trust atty and that's the only type i would ever recommend. ref ric edelman..initially i was a fan until he started preaching carrying a huge mortgage to use the funds to invest. bad, no, horrible idea. unnecessary risk.

We had an FA and our CPA work together to analyze several scenarios for us and recommend the best cash flow plan for us taking into account the various income streams we have or will have as well as our taxable portfolio and IRA’s. Well worth it for us, but we manage our own investments now. We had an FA that charged 0.7% of AUM for a few years but once we retired, we decided to take that on ourselves. We now have access to the Fidelity Private Client advisor that we can meet with whenever we like.

DrRoy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Perhaps a fee only couple of meetings, then if you are comfortable, you can take it from there.

I am DIY with most of my investments at Fidelity. With Private Client status (over 1mm), I get effectively "free" advice from a personal rep and many general reps whenever I want without paying any fees whatsoever.

I have learned so much from this site/Bogleheads and reading articles/books.

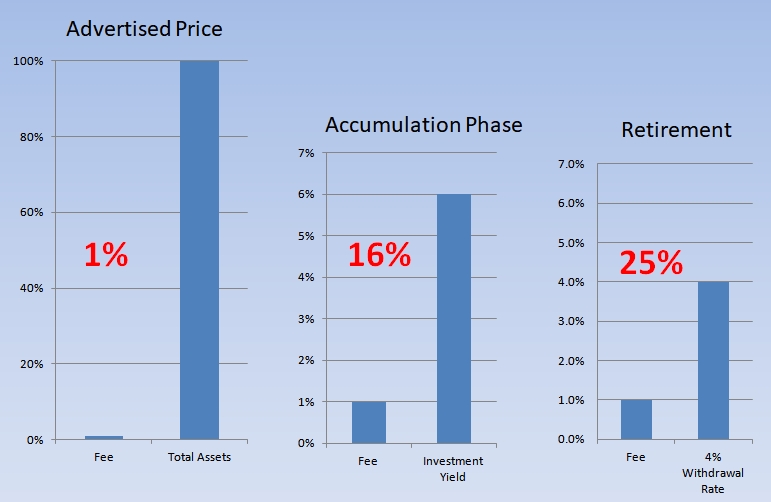

+2. I have this from Fido also. Under no circumstances should you go with a FA that charges by % of assets. Think of how large the fee is in terms of your WR.

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This is an interesting thread at Bogleheads, that discusses the "Retiree Portfolio Model".

https://www.bogleheads.org/forum/viewtopic.php?t=97352

I spent a few hours entering data, and have to say it is complicated. However, it seems to include every facet of retirement planning. That is why it is complex.

https://www.bogleheads.org/forum/viewtopic.php?t=97352

I spent a few hours entering data, and have to say it is complicated. However, it seems to include every facet of retirement planning. That is why it is complex.

travelover

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 31, 2007

- Messages

- 14,328

Yea, I think it is useful to talk in actual dollars - at 1% it is ten thousand dollars a year per million. If the FA actually spends 10 hours a year on you personally, that is a thousand bucks an hour. And if a safe withdrawal rate is 4%, that is forty thousand dollars a year and the FA gets a quarter of that. I know that it has been argued that there are mitigating factors to that ratio, but bucks is bucks........... Think of how large the fee is in terms of your WR.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This is an interesting thread at Bogleheads, that discusses the "Retiree Portfolio Model".

https://www.bogleheads.org/forum/viewtopic.php?t=97352

I spent a few hours entering data, and have to say it is complicated. However, it seems to include every facet of retirement planning. That is why it is complex.

Thanks. I clicked on the link but I can't seem to download the Model. Nothing comes up when I click on it.

VanWinkle

Thinks s/he gets paid by the post

Yea, I think it is useful to talk in actual dollars - at 1% it is ten thousand dollars a year per million. If the FA actually spends 10 hours a year on you personally, that is a thousand bucks an hour. And if a safe withdrawal rate is 4%, that is forty thousand dollars a year and the FA gets a quarter of that. I know that it has been argued that there are mitigating factors to that ratio, but bucks is bucks.

This is exactly how to look at it. You and OldShooter have it right!!

WestUniversity

Full time employment: Posting here.

- Joined

- Oct 7, 2017

- Messages

- 717

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Thank you. The other side of the debate is the question of what value-added the FA is providing for his fee. I think it is pretty universally understood that he/she cannot provide market-beating experience, but there are other factors.This is exactly how to look at it. You and OldShooter have it right!!

I was talking to a guy once who was working with Ameriprise. I gently indicated that they were not well thought of due to cost and performance. His response was a light bulb moment for me: "I know that. I know that they are expensive. But if it were not for this guy I wouldn't have anything."

Another angle I have heard from FAs is this: "If I keep my client from panic selling into down markets once or twice, I have earned more than all the fees he will ever pay me."

A good FA will also coach and badger an estate plan into being, will coach and badger health care powers, POA, etc. He/she may also be able to keep the clients from making mistakes on Social Security, pension lump sums, etc.

So IMO we need to remember that for some people the fees may be worth it.

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Stupid internet!Thanks. I clicked on the link but I can't seem to download the Model. Nothing comes up when I click on it.

You must have a popup blocker, or your browser will not spawn another tab or window.

What I get is: another browser tab opens, and it presents a dropbox login. I login to dropbox, and can either put the file in my dropbox, or download it to my computer.

- Joined

- Nov 27, 2014

- Messages

- 9,206

Stupid internet!

You must have a popup blocker, or your browser will not spawn another tab or window.

What I get is: another browser tab opens, and it presents a dropbox login. I login to dropbox, and can either put the file in my dropbox, or download it to my computer.

I have a clean version of Chrome on my desktop. When I open it, I have it set to got to private mode and to clear everything when it exits. Then whenever I’m having trouble with something working on Microsoft Edge, my normal browser, I try it on Chrome and 9 times out of ten, that will work. This tells me often it’s a setting I’ve chosen or the add blocker causing problems.

LOL!

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 25, 2005

- Messages

- 10,252

I'll repeat what has already been written:

Vanguard does no financial planning. Their pay-service is for investment management and not financial planning.

Unfortunately, I think it is very very difficult to find a decent financial planner who is worth what they might charge.

There is a service to find a financial planner for you that I think is probably very good although I have not used it:

https://thefinancebuff.com/find-advice-only-financial-advisors

Vanguard does no financial planning. Their pay-service is for investment management and not financial planning.

Unfortunately, I think it is very very difficult to find a decent financial planner who is worth what they might charge.

There is a service to find a financial planner for you that I think is probably very good although I have not used it:

https://thefinancebuff.com/find-advice-only-financial-advisors

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Not true.. Vanguard did a financial plan for me years ago. For free. It was worth a lot more than what I paid for it.

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Thanks for the tip. I use 1) Firefox, 2) Chrome, 3) Opera (built-in VPN). Usually, all three are open, and I don't have many "failures" per se.I have a clean version of Chrome on my desktop. When I open it, I have it set to got to private mode and to clear everything when it exits. Then whenever I’m having trouble with something working on Microsoft Edge, my normal browser, I try it on Chrome and 9 times out of ten, that will work. This tells me often it’s a setting I’ve chosen or the add blocker causing problems.

You gotta be ready for anything!

Maybe something in here might help

https://jpmorgansmartretirement.com/blobcontent/647/343/1272924627455_JP-GTR.pdf

https://jpmorgansmartretirement.com/blobcontent/647/343/1272924627455_JP-GTR.pdf

Similar threads

- Replies

- 36

- Views

- 3K

- Replies

- 15

- Views

- 480

- Replies

- 12

- Views

- 2K