So I have been looking into getting a CFP to assist with our retirement transition. I have always managed our money through an account with T Rowe Price. I do the best I can, though I am no expert for sure. I play around with fire calc and the Financial Engines tool through my husband's employer and also Future Path through T Rowe Price.

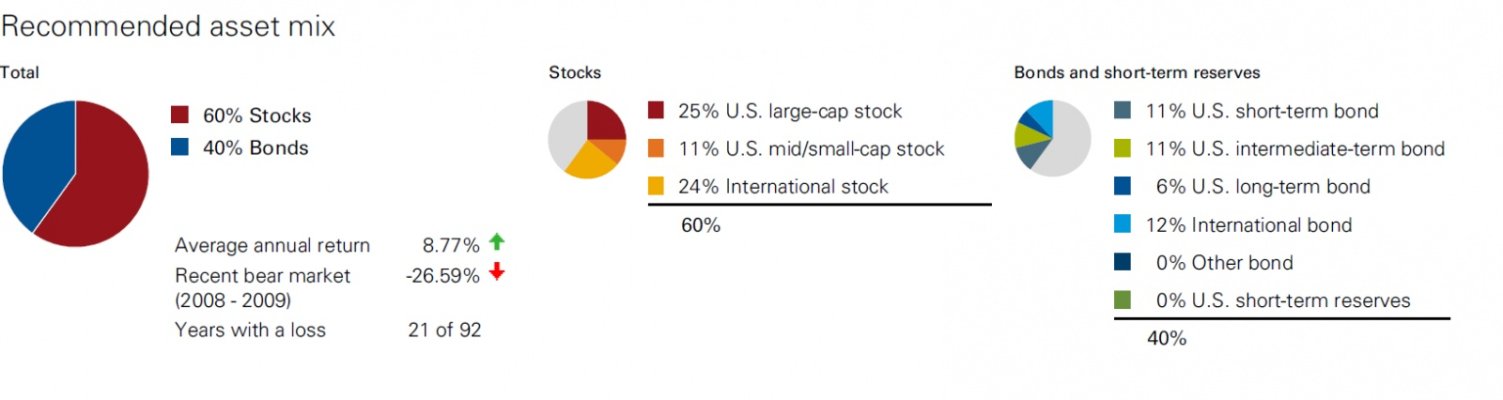

T Rowe Price also has a free advisory service in terms of investment decisions. But they always want me to take our cash- which I have a lot elsewhere- banks, etc.,- and put it in stock mutual funds. They say I am too conservative. Of course, I figure they want more of my money.

But when I use their on line tool- Future Path, it tells me we have a high score of 98 and even adjusting our asset mix with more stocks the result is the same- we are good. So I don't get why they insist I need more exposure to stock mutual funds.

What we really need is someone to help us decide when to take SS; help us with financial logistics of how to sell our home and move out of state; Advise us of how to withdraw our money to live on and taxes, since we have no pensions, Medicare and health insurance, and estate planning, etc.

What I DO NOT want is to turn our money in our T Rowe Price accounts over to the Financial Planner. I want the FP to give US the advice of what to do with it and WE take it from there on our own. Maybe meet a few times with the FP and pay by the hour or visit.

These FP's all seem to want to take our money and put it into like TD Ameritrade or Charles Schwalb and put it in their choice of funds and so forth. And it doesn't look like any of the funds are ones like Vanguard or Fidelity or T Rowe Price. They do tell me these funds they use are no load and all of that.

On top of it all- they have these huge fees- every single year.

I just recently spoke with a Dave Ramsey vetted FP from Rick Edelman Financial Engines. The charge is $800 for a financial plan and then a percentage of our assets every single year. Like 1.75% on the first $400,000 and then 1.25% on the next 350,000 and then 1% on the next $250,000 and then .75% on the next 2000000.00. You get the picture.

He, too, said we are too conservative and should go with more stocks and the Financial Engine tool also says this but yet when it calculates out what we have it looks like we are good the way we are.

I just don't get it.

This just seems so way out to me. I am trying to see if I can find someone to just give us advice on what to do. I am even considering maybe trying a CPA firm who can just look at what we have and make recommendations. Maybe at a later date as we age we would get someone to take over if and when we can't.

Any advice on this? I am really confused...