You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How long until sequence of returns risk no longer a concern?

- Thread starter ER Eddie

- Start date

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Again, the reality is no one robotically spends a fixed percentage of their portfolio annually.

Following the Boglehead-recommended variable percentage withdrawal (VPW) strategy significantly reduces exposure to SORR.

Sure. Any reduction in spend reduces exposure to SORR, regardless of how it is labelled.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I understand the concerns over sequence of returns and the possibility of a large drop in portfolio values just after retirement. There seems to be mitigation strategies such as changing asset allocation, increasing cash holdings, or using some of your nest egg to buy an annuity for guaranteed income just to name a few.

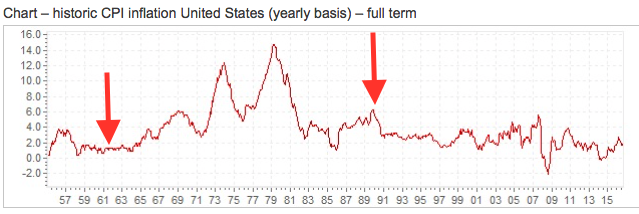

To me, the bigger worries or threats to prosperity are the more gradual but constant destroyers of wealth such as inflation and/or taxes. Those can eat up a large percentage of wealth and/or buying power and they are much more of a constant yearly threat rather than a singular major market correction assuming there isn’t a massive long term downturn in the markets.

I think that is true. Folks may invest more conservatively to reduce market exposure due to SORR fears. Unwittingly, they have reduced their nest egg through lower overall returns.

In some ways that is comparable to a strategy of investing in CD's due to fear of losing money in the market. As a result, you lose that money, just a little every day so perhaps it is not missed as quickly.

GravitySucks

Thinks s/he gets paid by the post

Instead of years in I think you need to look a years left.

I retired at 54 instead of 62 as planned. I'm heading towards year 7 of freedom at 61 yrs old. How would a 5 or 10 year in be relevent to SORR. The 32 more years I'm planning for is the relevent period.

My guess is 20 years left to live is when you can stop worrying.

I retired at 54 instead of 62 as planned. I'm heading towards year 7 of freedom at 61 yrs old. How would a 5 or 10 year in be relevent to SORR. The 32 more years I'm planning for is the relevent period.

My guess is 20 years left to live is when you can stop worrying.

Asset allocation makes a difference, and so can a rising equity glide path / bond tent.

https://earlyretirementnow.com/2019...cent-safe-withdrawal-rate-60-year-retirement/

https://earlyretirementnow.com/2019...cent-safe-withdrawal-rate-60-year-retirement/

RetiredAt55.5

Full time employment: Posting here.

Asset allocation makes a difference, and so can a rising equity glide path / bond tent.

https://earlyretirementnow.com/2019...cent-safe-withdrawal-rate-60-year-retirement/

Yes, I've read that somewhere before and wondered about implementing that myself.

But didn't, and got lucky since my first 3.5 years have benefited by a higher stock allocation.

Interesting, the author states "Most glidepaths—those in target-date funds—decrease the stock percentage to or even throughout retirement. That seems inefficient because SORR is most problematic 5 years before and 10 years after retirement, so there is no reason to keep the stock percentage low after most (all?) sequence risk has passed."

So, we have an opinion that 10 is the magic number of years to worry post retirement about SORR. But note, he is talking in the context of a 60 year retirement horizon. So, do we double 5 to get to 10?

Last edited:

HI Bill

Thinks s/he gets paid by the post

- Joined

- Dec 26, 2017

- Messages

- 2,556

What all SORR discussions should include is the duration of time between retirement and the date at which one starts taking pension and/or SS distributions. This is included in FIRECALC. It also takes into account the proportion of your post-SS start date fixed income versus what you take from the markets. The number of years will be different for each scenario, if SS/pensions or other future income will make up a significant portion of one’s income.

Last edited:

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

We've optimized our spending so that pensions and SS cover most of our expenses, and we don't have high allocation to stocks. If we can get at least a 0% real return with our fixed income investments in assets like TIPS and CD ladders, we can withdraw 3.33% at our ages which is more than fine for our retirement plan (100 / 30 years = 3.33%).

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

What all SORR discussions should include is the duration of time between retirement and the date at which one starts taking pension and/or SS distributions. This is included in FIRECALC. It also takes into account the proportion of your post-SS start date fixed income versus what you take from the markets. The number of years will be different for each scenario, if SS/pensions or other future income will make up a significant portion of one’s income.

True, once a person hits the SS age, even if they delay SS, the risk of SORR diminishes quite a bit, if the person didn't include SS withdrawals in their original plan.

If they did include SS amounts or value in their withdrawal plan, then SS will still have benefit as that portion doesn't drop in value, but the effect will be less.

IMO, it's not how long you've been retired, but how old you are, (i.e. how many years you are likely to have left ), and your WR, and how deeply invested you are in the market.

If you are 50 years old, and have been retired for 10 years, you may be more exposed to SORR than a 65 year old who has just retired.

If you need to be heavily invested in equities in order to generate enough income to live, you are more exposed than someone who can survive with less risk.

If you can generate enough income to fund your retirement lifestyle with a 30-70 AA, you are less vulnerable than someone who needs a 90-10 AA, to generate enough income to fund his/her lifestyle.

If you are 50 years old, and have been retired for 10 years, you may be more exposed to SORR than a 65 year old who has just retired.

If you need to be heavily invested in equities in order to generate enough income to live, you are more exposed than someone who can survive with less risk.

If you can generate enough income to fund your retirement lifestyle with a 30-70 AA, you are less vulnerable than someone who needs a 90-10 AA, to generate enough income to fund his/her lifestyle.

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Kitces had mentioned that the real return of a portfolio at the end of 15 years has a very high correlation to the ultimate success of the lifetime survival of the portfolio.

It doesn't mean that the SORR is specifically 15 years, but just another point of reference.

It doesn't mean that the SORR is specifically 15 years, but just another point of reference.

If you define SORR as risk of prematurely running out of money before running out of life for a particular inflation adjusted withdrawal rate, then I would suggest looking into a different withdrawal method. Perhaps one that has no SORR but instead has SOIR (sequence of Income Risk).

In other words, perhaps look at a method where you can't deplete your portfolio before your planned depletion date. You, instead, will have withdrawals that vary year upon year with the market itself. SOIR comes in if any year's withdrawal is below what's needed to cover minimum expenses. Withdrawals would not be adjusted for inflation but would rely on your long term portfolio returns for that.

SOIR is mitigated by

1. Having so much saved up that a calculated withdrawal us unlikely to ever be below your minimum required for expenses. This can be backtested, but just like the 4% rule and it's relatives, past does not guarantee the future.

2. Guaranteed income streams such as SS, a Pension or a SPIA

3. There may be years where the calculated withdrawal is so high you couldn't possibly spend it all. Nothing forces you to actually make the entire withdrawal. You can just withdraw what you need and the rest stays in to (hopefully) grow and (hopefully) mitigate any future bad year. Or you could withdraw the excess and save it off elsewhere as a buffer for a future bad year.

4. Don't slavishly follow a spreadsheet. If one year the calculation says withdraw 4.8% and you actually need 5.0%, you gotta do what you gotta do. Most of the methods don't care about what was done in the past and only end up calculating a percentage to withdraw from whatever is in the portfolio at the time.

Examples of such withdrawal methods include

VPW:

https://www.bogleheads.org/wiki/Variable_percentage_withdrawal

Math is done assuming future real stock & bond returns look like the long term historical past. A spreadsheet exists for download.

Time Value of Money (TVM)

Two parts to this one

1. Using NPV concepts like the current value of your SS stream if you haven't started taking SS or a pension or a future lump sum etc. Though you can do this for any withdrawal scheme.

2. Similar math as VPW, but can be adopted to use metrics to guess at medium return stock returns (using something like 1/PE10) and current real rates for bonds in the PMT math. Accuracy of these estimates isn't required, but they do tend to smooth out the withdrawals somewhat.

This thread on bogleheads discusses it.

https://www.bogleheads.org/forum/viewtopic.php?t=263790

An example spreadsheet to understand the concepts (this uses VPW math)

https://docs.google.com/spreadsheet...oWcHzZt8EPaeDe5vJqBSXcYTRU/edit#gid=357005038

A couple of articles that discuss this idea further (including discussions about calculating expected returns for the PMT math)

https://medium.com/@justusjp/flavors-of-pmt-based-withdrawals-part-1-of-2-mortality-dbe09aed5be1

https://medium.com/@justusjp/flavor...als-part-2-of-2-expected-returns-a7486445a4d1

There is also just taking a fixed percentage of your portfolio every year with no inflation adjustment. Guaranteed to last forever. Though, if you choose too high a percentage, your portfolio value and withdrawals could drop severely over time. Firecalc can do this one. The setting is on the "Spending Models" tab. Has the benefit of being simple and can be done with pen and paper or just a calculator.

https://www.firecalc.com/

There are a host of other methods out there that use various algorithms to adjust your withdrawals up or downwards. I personally like the ones whose underlying math guarantees no premature depletion before I would want it to. Many of the others were developed by datamining the past to show that it would have worked in the past (just like the 4% rule). Regardless of what one does, there is no 100% guarantee.

There are other calculators out there that can help guide you with things like when/if to do Roth conversions, which accounts to withdraw from, how much, and when, etc.

One of the most popular is I-ORP. Be sure to choose "Extended I-ORP".

https://www.i-orp.com/Merit/index.html

The main problem with tools like I-ORP is that, at the end of the day, it still assumes a fixed withdrawal, adjusted annually for inflation. If you use a variable withdrawal method, then it's still possible to use this for guidance, just not quite 100% apples-to-apples.

Cheers.

In other words, perhaps look at a method where you can't deplete your portfolio before your planned depletion date. You, instead, will have withdrawals that vary year upon year with the market itself. SOIR comes in if any year's withdrawal is below what's needed to cover minimum expenses. Withdrawals would not be adjusted for inflation but would rely on your long term portfolio returns for that.

SOIR is mitigated by

1. Having so much saved up that a calculated withdrawal us unlikely to ever be below your minimum required for expenses. This can be backtested, but just like the 4% rule and it's relatives, past does not guarantee the future.

2. Guaranteed income streams such as SS, a Pension or a SPIA

3. There may be years where the calculated withdrawal is so high you couldn't possibly spend it all. Nothing forces you to actually make the entire withdrawal. You can just withdraw what you need and the rest stays in to (hopefully) grow and (hopefully) mitigate any future bad year. Or you could withdraw the excess and save it off elsewhere as a buffer for a future bad year.

4. Don't slavishly follow a spreadsheet. If one year the calculation says withdraw 4.8% and you actually need 5.0%, you gotta do what you gotta do. Most of the methods don't care about what was done in the past and only end up calculating a percentage to withdraw from whatever is in the portfolio at the time.

Examples of such withdrawal methods include

VPW:

https://www.bogleheads.org/wiki/Variable_percentage_withdrawal

Math is done assuming future real stock & bond returns look like the long term historical past. A spreadsheet exists for download.

Time Value of Money (TVM)

Two parts to this one

1. Using NPV concepts like the current value of your SS stream if you haven't started taking SS or a pension or a future lump sum etc. Though you can do this for any withdrawal scheme.

2. Similar math as VPW, but can be adopted to use metrics to guess at medium return stock returns (using something like 1/PE10) and current real rates for bonds in the PMT math. Accuracy of these estimates isn't required, but they do tend to smooth out the withdrawals somewhat.

This thread on bogleheads discusses it.

https://www.bogleheads.org/forum/viewtopic.php?t=263790

An example spreadsheet to understand the concepts (this uses VPW math)

https://docs.google.com/spreadsheet...oWcHzZt8EPaeDe5vJqBSXcYTRU/edit#gid=357005038

A couple of articles that discuss this idea further (including discussions about calculating expected returns for the PMT math)

https://medium.com/@justusjp/flavors-of-pmt-based-withdrawals-part-1-of-2-mortality-dbe09aed5be1

https://medium.com/@justusjp/flavor...als-part-2-of-2-expected-returns-a7486445a4d1

There is also just taking a fixed percentage of your portfolio every year with no inflation adjustment. Guaranteed to last forever. Though, if you choose too high a percentage, your portfolio value and withdrawals could drop severely over time. Firecalc can do this one. The setting is on the "Spending Models" tab. Has the benefit of being simple and can be done with pen and paper or just a calculator.

https://www.firecalc.com/

There are a host of other methods out there that use various algorithms to adjust your withdrawals up or downwards. I personally like the ones whose underlying math guarantees no premature depletion before I would want it to. Many of the others were developed by datamining the past to show that it would have worked in the past (just like the 4% rule). Regardless of what one does, there is no 100% guarantee.

There are other calculators out there that can help guide you with things like when/if to do Roth conversions, which accounts to withdraw from, how much, and when, etc.

One of the most popular is I-ORP. Be sure to choose "Extended I-ORP".

https://www.i-orp.com/Merit/index.html

The main problem with tools like I-ORP is that, at the end of the day, it still assumes a fixed withdrawal, adjusted annually for inflation. If you use a variable withdrawal method, then it's still possible to use this for guidance, just not quite 100% apples-to-apples.

Cheers.

Last edited:

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Kitces had mentioned that the real return of a portfolio at the end of 15 years has a very high correlation to the ultimate success of the lifetime survival of the portfolio.

It doesn't mean that the SORR is specifically 15 years, but just another point of reference.

I tend to agree with this. I have seen on the low end 5 years with most sources saying 10 or more. My plan includes a rising equity allocation.

One of the things that really helped me get my head around my strategy was to fill out a bucket spreadsheet. What do I have in the 1-3 year, 4-9 and 10+ year buckets. I am somewhat overweighted in the middle bucket so I have flexibility on whether that goes into bucket 1 or 3.

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,236

I don't see how it can be X number of years in an ER world. It's got to be longer for a healthy 40 yo than a 60 yo. A strong bull market could end SORR for all but not a so-so run. I would look at how many years left as the guide.

Andre1969

Thinks s/he gets paid by the post

I thought the 4% rule took into effect sequence of returns risk? So I guess I'd say you don't have to wait. That's why many people say 4% is too cautious. Having said that I just retired last year and having such a great year this year sure makes me feel better. Another up year ( just decent) will go a long way to make me feel really good.

It does take sequence of returns risk into account. That's why 4% adjusted for inflation for 30 years gives you a 95% chance of success, and not 100%. 5% of the cycles that were back-tested failed. Most likely, those were cycles that had a bad sequence of returns early in the cycle.

If you run that calculation through FireCalc, it has 119 30 year cycles to pull data from. 6 of them failed, and 113 passed. However, it should be noted that, at the end of 30 years, a good deal of the cycles are trending steadily downward, and even though they're technically a "success" for 30 years, they're pretty much guaranteed to be doomed to failure a few years later.

TheWizard

Thinks s/he gets paid by the post

After you start SS at age 70, SoR risk becomes much less of a concern.

I had seven years of retirement prior to age 70 and if a crash had happened early in that span, it would have upset my plan.

Fortunately, things worked out fine and I have now won the game...

I had seven years of retirement prior to age 70 and if a crash had happened early in that span, it would have upset my plan.

Fortunately, things worked out fine and I have now won the game...

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I heard a good guide on a Deep Pockets podcast not too long ago.

When your expenses as a percentage of your portfolio starts to approach the dividend rate of your portfolio, you can move more into equities.

When your expenses as a percentage of your portfolio starts to approach the dividend rate of your portfolio, you can move more into equities.

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

To me, the bigger worries or threats to prosperity are the more gradual but constant destroyers of wealth such as inflation and/or taxes. Those can eat up a large percentage of wealth and/or buying power and they are much more of a constant yearly threat rather than a singular major market correction assuming there isn’t a massive long term downturn in the markets.

+1

It does take sequence of returns risk into account. That's why 4% adjusted for inflation for 30 years gives you a 95% chance of success, and not 100%. 5% of the cycles that were back-tested failed. Most likely, those were cycles that had a bad sequence of returns early in the cycle.

If you run that calculation through FireCalc, it has 119 30 year cycles to pull data from. 6 of them failed, and 113 passed. However, it should be noted that, at the end of 30 years, a good deal of the cycles are trending steadily downward, and even though they're technically a "success" for 30 years, they're pretty much guaranteed to be doomed to failure a few years later.

Others have said it, but just to repeat it. It only gives you the probability of success if you had both started and completed a retirement in the past. It is not a law-of-the-universe type of concept. Not every possible sequences of returns (or more importantly, reasons for those sequences) have occurred in the past.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Since I retired a bit over twenty years ago, you’d think I feel like SORR is passed (especially surviving 2000-2002 and 2008/9). But I don’t, because I just turned 60, so I still have a potentially long retirement and don’t want to run out of money. High valuations for markets always makes me nervous.

Our portfolio has grown significantly since retiring, including after inflation. We use a variable income method, the simple constant %remaining portfolio method for withdrawals. Even though our portfolio has grown so much, so proportionally have our withdrawals. We are protected from SORR due to our withdrawals which will drop with portfolio losses, but I still had to carefully study the issue to determine how low our portfolio could possibly drop and thus our income. It typically comes down to something like a potential inflation adjusted drop of 55% or even more depending on rate and AA - and it can take well over a decade to get there - 17 years in some scenarios!

So you have to take a hard look at how to handle this varying income stream. Having a high percentage of discretionary expenses (being able to cut back aggressively when necessary) is certainly a good idea, as is perhaps not ramping up your spending as aggressively as your portfolio grows during the good times, and perhaps allowing excess income to accumulate to help tide over the bad times.

Anyway, I never trusted using the inflation adjusted income traditional method, and opted for a method that rises and falls with the portfolio. And then I had to come up with ways (that I felt comfortable with) to reasonably handle the income variability including a potentially nasty sequence of shrinking income over a long period. Potential for that last part never goes away, but is at least mitigated by the retirement period gradually shortening.

Our portfolio has grown significantly since retiring, including after inflation. We use a variable income method, the simple constant %remaining portfolio method for withdrawals. Even though our portfolio has grown so much, so proportionally have our withdrawals. We are protected from SORR due to our withdrawals which will drop with portfolio losses, but I still had to carefully study the issue to determine how low our portfolio could possibly drop and thus our income. It typically comes down to something like a potential inflation adjusted drop of 55% or even more depending on rate and AA - and it can take well over a decade to get there - 17 years in some scenarios!

So you have to take a hard look at how to handle this varying income stream. Having a high percentage of discretionary expenses (being able to cut back aggressively when necessary) is certainly a good idea, as is perhaps not ramping up your spending as aggressively as your portfolio grows during the good times, and perhaps allowing excess income to accumulate to help tide over the bad times.

Anyway, I never trusted using the inflation adjusted income traditional method, and opted for a method that rises and falls with the portfolio. And then I had to come up with ways (that I felt comfortable with) to reasonably handle the income variability including a potentially nasty sequence of shrinking income over a long period. Potential for that last part never goes away, but is at least mitigated by the retirement period gradually shortening.

Last edited:

Since I retired a bit over twenty years ago, you’d think I feel like SORR is passed (especially surviving 2000-2002 and 2008/9). But I don’t, because I just turned 60, so I still have a potentially long retirement and don’t want to run out of money. High valuations for markets always makes me nervous.

Our portfolio has grown significantly since retiring, including after inflation. We use a variable income method, the simple constant %remaining portfolio method for withdrawals. Even though our portfolio has grown so much, so proportionally have our withdrawals. We are protected from SORR due to our withdrawals which will drop with portfolio losses, but I still had to carefully study the issue to determine how low our portfolio could possibly drop and thus our income. It typically comes down to something like a potential inflation adjusted drop of 55% or even more depending on rate and AA - and it can take well over a decade to get there - 17 years in some scenarios!

So you have to take a hard look at how to handle this varying income stream. Having a high percentage of discretionary expenses (being able to cut back aggressively when necessary) is certainly a good idea, as is perhaps not ramping up your spending as aggressively as your portfolio grows during the good times, and perhaps allowing excess income to accumulate to help tide over the bad times.

Anyway, I never trusted using the inflation adjusted income traditional method, and opted for a method that rises and falls with the portfolio. And then I had to come up with ways (that I felt comfortable with) to reasonably handle the income variability including a potentially nasty sequence of shrinking income over a long period. Potential for that last part never goes away, but is at least mitigated by the retirement period gradually shortening.

With a fixed percentage of remaining portfolio method, you don't have SORR. You have SOIR (see my post upstream).

SORR usually refers to risk of prematurely depleting your portfolio. SOIR (which started being used on bogleheads recently) refers to having a withdrawal below your minimum required to pay your bills in any year. Not quite standard terminology yet, I know, but I like it.

Last edited:

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Why would you let your withdrawal % drop?I heard a good guide on a Deep Pockets podcast not too long ago.

When your expenses as a percentage of your portfolio starts to approach the dividend rate of your portfolio, you can move more into equities.

I suspect I’ll let mine go up as I get older.

Last edited:

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

With a fixed percentage of remaining portfolio method, you don't have SORR. You have SOIR (see my post upstream).

SORR usually refers to risk of prematurely depleting your portfolio. SOIR (which started being used on bogleheads recently) refers to having a withdrawal below your minimum required to pay your bills in any year. Not quite standard terminology yet, I know, but I like it.

(BTW, it looks like you hit "return" before getting to the end of your last sentence)

That’s right, I was still editing and accidentally touched the post button. So you could always update the quote if you wanted.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Why would you let your withdrawal % drop?

I suspect I’ll let mine go up as I get older.

The key being expenses or your base amount you need to get by, not total withdrawals. I agree those should go up as we get older.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 18

- Views

- 882

- Replies

- 87

- Views

- 9K

- Replies

- 43

- Views

- 2K