AlmostThoreau

Dryer sheet wannabe

- Joined

- Oct 18, 2023

- Messages

- 16

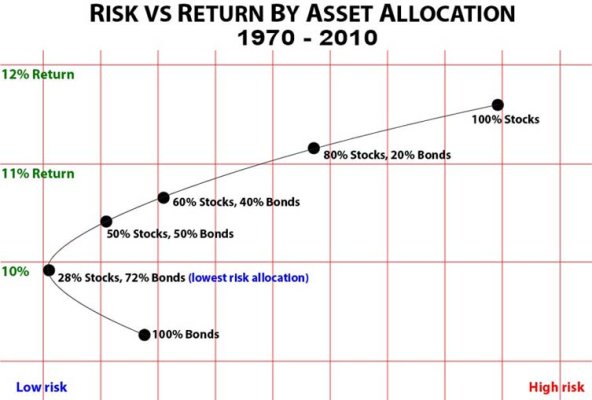

I'm a 50 year old recent retiree, and my asset allocation is around 75% stocks, 25% bonds. I figure by accepting more stock risk I can *probably* enjoy a higher standard of living in retirement.

Maybe not. The excellent TPAW retirement planner (https://tpawplanner.com/) shows, with a hypothetical $3M portfolio, I can draw down $10.5k/month in Year 1 with an all bond portfolio, but just $7.5k/month with an all stock portfolio. And that's after bumping up stock returns to 5.3% real, a full 3% over the 2.3% real bond (TIPS) return it assumes.

How is this possible? The variability of stock returns means you've got to be more conservative with spending in the early years of retirement, since a few bad years (sequence of return risk) then can cause you to run out of money later. And that's even with TPAWs variable withdrawal rate scheme, where you withdrawal more or less based on prior year's returns.

Eventually, stocks catch up - by age 64 or so, you can expect to spend a bit more with an all-stock, than an all-bond portfolio. By age 80, twice as much. But does anyone really spend twice as much in retirement at age 80 than age 50?

I've seen few advocates of 100% bond portfolios here. But especially with the availability of TIPS to neutralize inflation, it may be a path to consider.

Maybe not. The excellent TPAW retirement planner (https://tpawplanner.com/) shows, with a hypothetical $3M portfolio, I can draw down $10.5k/month in Year 1 with an all bond portfolio, but just $7.5k/month with an all stock portfolio. And that's after bumping up stock returns to 5.3% real, a full 3% over the 2.3% real bond (TIPS) return it assumes.

How is this possible? The variability of stock returns means you've got to be more conservative with spending in the early years of retirement, since a few bad years (sequence of return risk) then can cause you to run out of money later. And that's even with TPAWs variable withdrawal rate scheme, where you withdrawal more or less based on prior year's returns.

Eventually, stocks catch up - by age 64 or so, you can expect to spend a bit more with an all-stock, than an all-bond portfolio. By age 80, twice as much. But does anyone really spend twice as much in retirement at age 80 than age 50?

I've seen few advocates of 100% bond portfolios here. But especially with the availability of TIPS to neutralize inflation, it may be a path to consider.