racy

Full time employment: Posting here.

- Joined

- May 25, 2007

- Messages

- 883

Always have, since 1977. It ain't rocket science.

We have never paid anyone to run our money and certainly would never pay 1.3%.

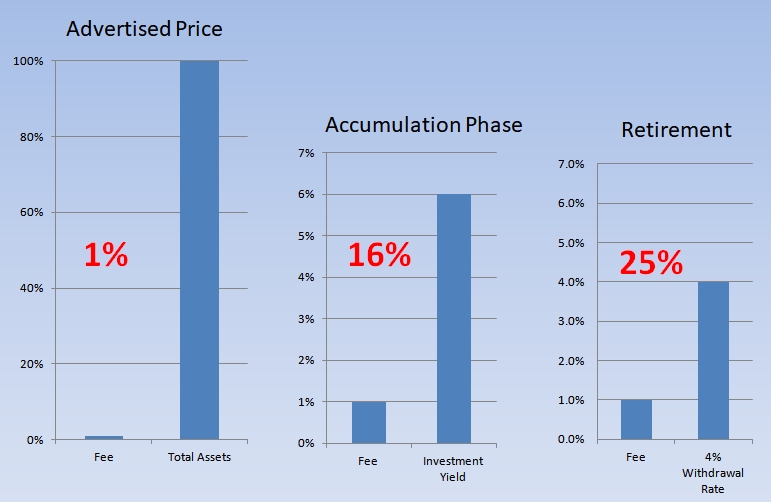

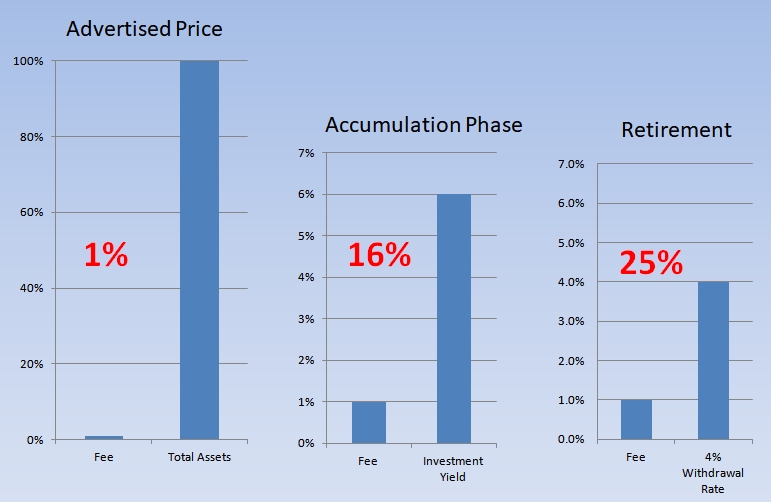

Here is a chart that I use with my investment class:

Buy and read "The Coffeehouse Investor" by Bill Schultheis and "The Bogleheads' Guide to Investing" by Larimore et al and you will know more than your FA.

Re moving everything to Vanguard Index Funds "next year," you should be there now. Why wait a year, which will almost certainly cost you at least 2% in underperformance? That's more than his fee.

I pay a fund manager 4% a year to manage our portfolio. He just happens to be me.

Same here, We have a FA with Fidelity that we meet with about once a year, ask any questions, etc. She will assume my job if I were to become unable to manage either cognitive problems or if I go before DW. Important for me to have a relationship between DW and FA today so they can work together later if needed. Oh, and FA is no cost today.I manage all our finances myself, but, importantly, I've also identified a FA my wife could work with after my death, should I die before her. This is a person I trust and who is familiar with my approach.

Managed mom's funds for about 15 years. Fired one FA and the 2nd one wouldn't put up with my intrusive oversight so I moved most of her assets to Fidelity and managed them till her passing this year. Thought this was worth quoting because many FA don't want your input.I've always managed my own. (And, I suspect that no manager would want to put up with my very intrusive oversight.)

Same here, We have a FA with Fidelity that we meet with about once a year, ask any questions, etc. She will assume my job if I were to become unable to manage either cognitive problems or if I go before DW. Important for me to have a relationship between DW and FA today so they can work together later if needed. Oh, and FA is no cost today.

We have never paid anyone to run our money and certainly would never pay 1.3%.

Here is a chart that I use with my investment class:

Buy and read "The Coffeehouse Investor" by Bill Schultheis and "The Bogleheads' Guide to Investing" by Larimore et al and you will know more than your FA.

Re moving everything to Vanguard Index Funds "next year," you should be there now. Why wait a year, which will almost certainly cost you at least 2% in underperformance? That's more than his fee.

I too have "my guy" at Fidelity. The downside is "my guy" has changed 3 times over the last 10 years or so. I have little faith that any relationship DW made at Fidelity will not be there when she, or I for that matter, may need one. What's a person to do? This succession planning concerns me more than my self-management of the family finances.