Hey R Wood - I was replying to the original poster who it appears does not have a cola'd pension (lucky you have one - I wish I did)

If you are happy with your return - good for you.

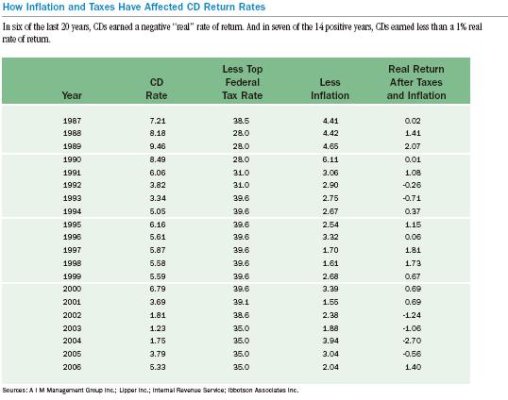

I stand corrected. Fixed income only keeps ahead if:

1. CPI really measures inflation (It doesn't - Ask CFB)

2. You make no withdrawals

3. You don't pay taxes

(and you are lucky enough to get the best rates)

hard to be retired under those conditions unless the income isn't needed - of course then why the discussion or worry?

If you are happy with your return - good for you.

I stand corrected. Fixed income only keeps ahead if:

1. CPI really measures inflation (It doesn't - Ask CFB)

2. You make no withdrawals

3. You don't pay taxes

(and you are lucky enough to get the best rates)

hard to be retired under those conditions unless the income isn't needed - of course then why the discussion or worry?

Last edited: