OK, against my better judgment, I'll take the bait. As you stated yourself, vehicles are assets. How quickly they depreciate does not change that basic fact. Cars are not, as several people have asserted in this thread, "just an expense like electricity." The money you spend on fuel, insurance, repairs, maintenance, taxes, registration, interest on a loan, etc... those are expenses. Even the depreciation in value is an expense, although most individuals don't use the accrual method of accounting in their personal finances. But the value of the vehicle itself is an asset. As such, it belongs on the balance sheet. Net worth is just a personal version of a company's balance sheet, subject to many of the same reporting expectations and measurement criteria. See

AICPA SOP 82-1.

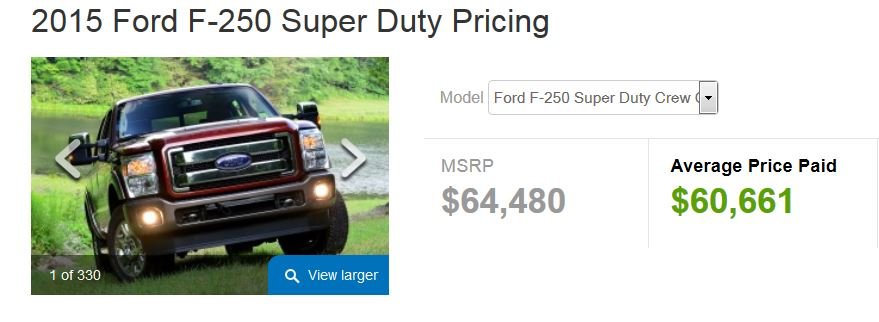

Now... you certainly may choose to exclude it from your own personal net worth calculation for whatever reason you want. The most common legitimate reason for this is immateriality, as evidenced by most, but not all, of the answers on this thread. I exclude cars from my current NW calculation for that reason. But if I went out tomorrow and converted $50K cash into an F-250, yes, I would include it, as my financial position at that moment is unchanged by the transaction.

I also see people on this forum make comments like, "I don't include my house in net worth because I have to live somewhere." Same issue, only more problematic because house values are generally material to NW. And I think in both cases, the problem is derived from the fact that this is a forum dominated by topics about retirement planning. Generally, what the person really means is: "I don't include my house in

the subset of assets from which I expect to derive retirement income because I have to live somewhere." The problem stems from a simple misunderstanding of what is actually meant by net worth, which is much closer to aja8888's description: