So let me test this TIPs ladder idea using the example in post #163, but to make it more realistic for street, I'll multiply all the values by 3 ($3,000/month PIA rather than $1,000/month PIA)... so the subject forgoes $25,200 a year (rather than $8,400 a year) of SS from age 62 to 70... total of $201,600 but will receive an additional $19,440 annually (rather than $6,480 annually) starting at 70.

Also, let's say that the person expects to live to be 83, consistent with SS mortality tables... so if they are 62 now in 2023 they would be 70 in 2031 and 83 in 2044

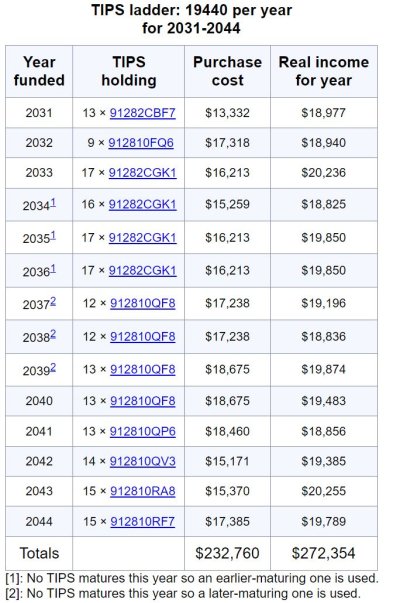

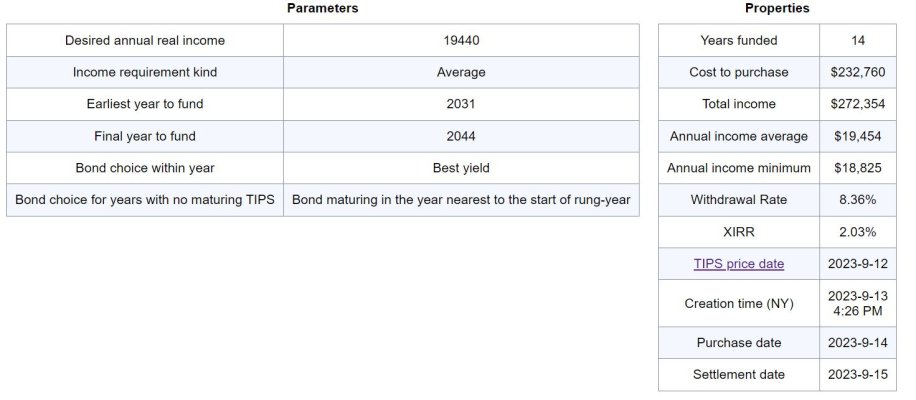

With the TIPs ladder tool I built a TIPS ladder that would provide $19,440 of inflation adjusted cash flow from 2031 to 2044... $272,354 total divided by 14 years is an average of $19,545 (as close as you can come given that you have to buy in $1,000 increments). That tool seems to suggest that it would cost $232,760 today to buy a TIPS portfolio that produces an average of $19,545 of inflation adjusted cash flows from 2031 to 2044.

But you can buy the same thing from the SSA for $201,600 by forgoing $25,200 a year from 62 to 70.

While I'm not totally sure that I am using the TIPS ladder tool correctly, if it is close then it seems like buying those enhanced cash flows from SSA is a good deal. You could say, yeah but what if you don't life to 83? Valid point, but I would counter with, yeah, but what if you live to 90 or 95 or 100?

Or looked at another way, going back to the table at post#163, if you live to 83 then the brekeven real IRR is 3.3%, but with TIPs the best that you can get is 2.03%, so the SS has a higher return.

https://www.tipsladder.com/build?in...hinYear=BestYield&excludePreLadderInterest=on