ExFlyBoy5

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Instead of YTD increase, I wanted to know the price increase since pre-Covid time.

I went to the above Web site to look at the current prices of the above commodities, plus their prices on Jan 2020 (pre-Covid).

I then computed the price increases shown in the table below. It is bleak, unless you are a user of wool and heating oil.

Commodity Price 5/6/2021 Price 1/1/2020 % Increase Beef 20.39 14.21 43% Poultry 7.14 5.35 34% Lean Hog 111.4 68.55 63% Canola 1003 545 84% Wheat 765 554 38% Coffee 149 103 45% Sugar 17.58 13.31 32% Corn 760 392 32% Wool 1319 1558 -15% Lumber 1645 407 304% Milk 23.57 16.93 39% Gasoline 2.1171 1.7155 23% Heating Oil 1.989 2.02 -1.5% Crude 64.93 63.54 2.2%

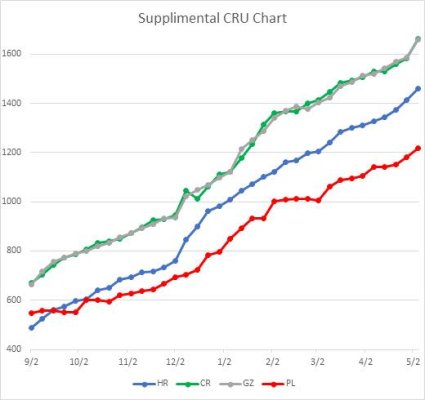

Another one that a friend that is in the manufacturing business shared with me. This is price of hot rolled, cold rolled, galvanized and plate steel from 9/20 to 5/21.