You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I thought I understood opensocialsecurity.com ...

- Thread starter stephenson

- Start date

Don't forget to modify your current spending to account for the estimated inflation rate compounded over 13 years (2023 to 2036). Both must be measured by future dollars.

Yes. In the retirement planning software I'm using, it automatically adjust my living expenses by 3% each year (3% Living Expense Inflation).

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yes. In the retirement planning software I'm using, it automatically adjust my living expenses by 3% each year (3% Living Expense Inflation).

Same here, except I use home brewed Excel.

Same here, except I use home brewed Excel.

OFF TOPIC. Maybe a new thread.. I wonder how accurate these retirement planning tools can predict the retirement readiness for a couple. I'm currently using 3 retirement planning tools right now.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Actually it does indirectly. Your "Spouse, if benefits start at full retirement age:" amount is your current exact PIA after you're older than FRA. I know because I went through the exact same issue getting opensocialsecurity to reflect correct numbers for me...

Good tip, didn’t know that.

But doesn’t spouse get 50% of your current benefits in they file after FRA (assuming it’s greater than their benefit)?

Last edited:

Ok. If I use the average of 3.01%, that is $6098 per month at age 70 in 2036. Around $73K per year in SS benefits for me alone. That would be insane.

The COLA is not free money. It's just inflation adjustment.

$73K in 2036 is not the same as $73K in 2023.

At one point I used 5 calculators and got 3 different ranges of results. 2 said "nope you're going to go broke", 2 said I'll die with more money than I have now, and 1 goldilocks scenario of hitting 0 savings right at life expectancy.OFF TOPIC. Maybe a new thread.. I wonder how accurate these retirement planning tools can predict the retirement readiness for a couple. I'm currently using 3 retirement planning tools right now.

I then expanded to over a dozen calculators... some are way to simplistic and a lot of them actually use the same tool under the covers. By being extremely careful to adjust the data entered for each calculator to get valid comparisons all of the tools gave numbers in the same general area... but it took way too much work to normalize the inputs.

I even built my own spreadsheet that used a row for each year and a whole lotta columns to adjust spending, taxes, SS, interest income, inflation drop life insurance in year X, etc.

The end result: just use 2 PMT functions (1 taxable savings, 1 tax deferred) and 1 row for annualized average SS over your lifetime (ex. tax the results from opensocialsecurity and divide by live expectancy). Add those 3 numbers together and look at the results with an eye towards inflation. If you don't like the number, work longer.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

They can't be "accurate" as there are way too many variables they can't "know." Unless you can project longevity, market returns, inflation, future Soc Sec, geopolitical events and future tax rates - among other variables, no calculator can "predict" anything. The best they can do is tell you how you would have fared in the past (FIRECALC) or how you would fare based on whatever assumptions you/they are using. Many of the free calculators don't even disclose their assumptions.OFF TOPIC. Maybe a new thread.. I wonder how accurate these retirement planning tools can predict the retirement readiness for a couple. I'm currently using 3 retirement planning tools right now.

And if the tool is wrong, you probably won't know it until it's too late, long after you've retired. You decide what safety factors you need to sleep at night, and take your chances...

Look at the range of actual historical outcomes FIRECALC generates. Any reason to expect the future would be more predictable?

Last edited:

This is my conundrum with SS. According to opensocialsecurity.com there is approx $171,000 difference between taking SS at FRA and 70. The yearly difference is approx $57,000 rounding. So, approx 12 years to make up that difference in income.

I understand longevity and the difference if one of us passes early. But if we both make it to 70, we are ahead. Our taxable index funds IRR make (an average over the last 10 years)

10 yr - 8.3%

5 yr - 8.3%

3 yr - 10.6%

1 yr - 15.1%

As of this year, we will be WD from those funds for income. Does it make sense to take SS at 70 instead of FRA?

I understand longevity and the difference if one of us passes early. But if we both make it to 70, we are ahead. Our taxable index funds IRR make (an average over the last 10 years)

10 yr - 8.3%

5 yr - 8.3%

3 yr - 10.6%

1 yr - 15.1%

As of this year, we will be WD from those funds for income. Does it make sense to take SS at 70 instead of FRA?

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This is my conundrum with SS. According to opensocialsecurity.com there is approx $171,000 difference between taking SS at FRA and 70. The yearly difference is approx $57,000 rounding. So, approx 12 years to make up that difference in income.

I understand longevity and the difference if one of us passes early. But if we both make it to 70, we are ahead. Our taxable index funds IRR make (an average over the last 10 years)

10 yr - 8.3%

5 yr - 8.3%

3 yr - 10.6%

1 yr - 15.1%

As of this year, we will be WD from those funds for income. Does it make sense to take SS at 70 instead of FRA?

This link might interest you (video is on 5 SS "myths"; timestamp is to myth #5 which is that "claim early and invest will win"):

The COLA is not free money. It's just inflation adjustment.

$73K in 2036 is not the same as $73K in 2023.

Yep. In my retirement planning software, I'm inflating my living expenses and healthcare accordingly.

They can't be "accurate" as there are way too many variables they can't "know." Unless you can project longevity, market returns, inflation, future Soc Sec, geopolitical events and future tax rates - among other variables, no calculator can "predict" anything. The best they can do is tell you how you would have fared in the past (FIRECALC) or how you would fare based on whatever assumptions you/they are using. Many of the free calculators don't even disclose their assumptions.

And if the tool is wrong, you probably won't know it until it's too late, long after you've retired. You decide what safety factors you need to sleep at night, and take your chances...

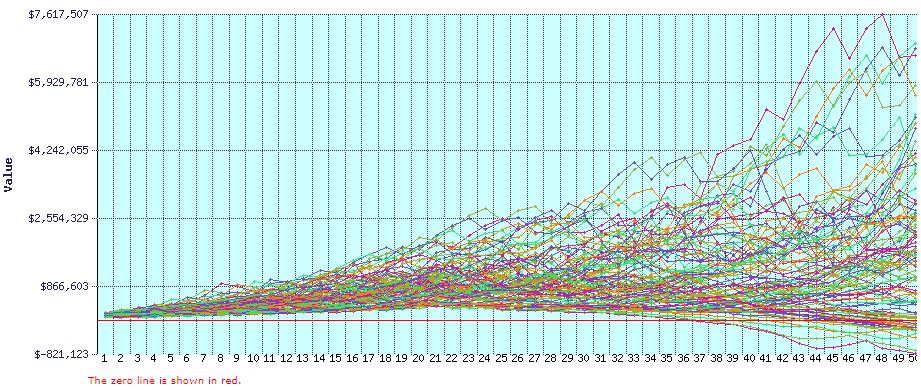

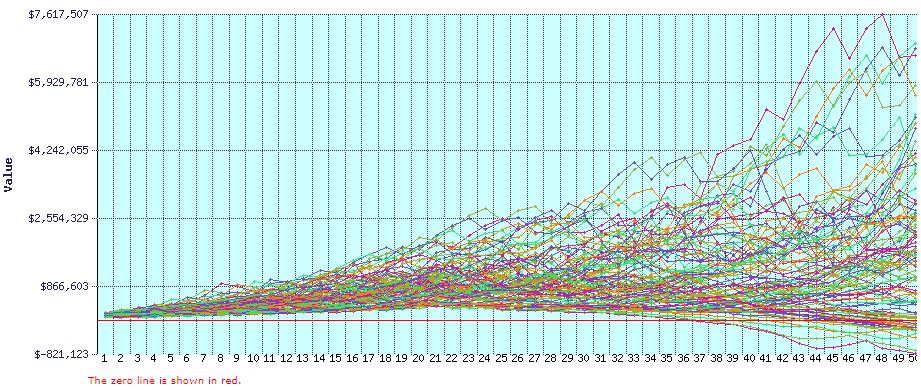

Look at the range of actual historical outcomes FIRECALC generates. Any reason to expect the future would be more predictable?

Ok. So is it simply a matter of cash outflows and cash inflows? Meaning if you have enough monthly income to pay for your monthly expenses during your retirement lifetime, then you have the green light.

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Ok. So is it simply a matter of cash outflows and cash inflows? Meaning if you have enough monthly income to pay for your monthly expenses during your retirement lifetime, then you have the green light.

Sure.

The trick is knowing what your income, expenses, and lifetime will be. In the future. Which is hard to predict. So you have to guess.

Sure.

The trick is knowing what your income, expenses, and lifetime will be. In the future. Which is hard to predict. So you have to guess.

Just curious. What retirement planning tool are you using? Home-grown spreadsheet?

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Just curious. What retirement planning tool are you using? Home-grown spreadsheet?

I use a variety of tools, depending on the specific need. I use the 4% rule itself, FIREcalc, the Rich/Broke/Dead web page, Quicken, and a collection of home grown spreadsheets centered on topics - my finances, my Dad's finances, my RMD projection, and my HSA projection. Before I FIREd, I ran a bunch of online tools.

I also have some Word documents and tools related to planning what I actually do (as contrasted with the money piece of it).

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Many here use FIRECALC, but there other good ones. But since that’s rear view mirror, we each have to decide what probability of success we can live with, and even hedge from there if that’s what it takes to be comfortable with your plan. I’ve seen people here comfortable at 75-80%, some need 200% or my (like me), and others fall in between. Then you re-evaluate as you go, every 5 years or more often, and adjust as necessary.Just curious. What retirement planning tool are you using? Home-grown spreadsheet?

No planning tool can predict anything certain, you have to make your own judgement.

Last edited:

Similar threads

- Replies

- 35

- Views

- 4K

- Replies

- 30

- Views

- 3K