daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

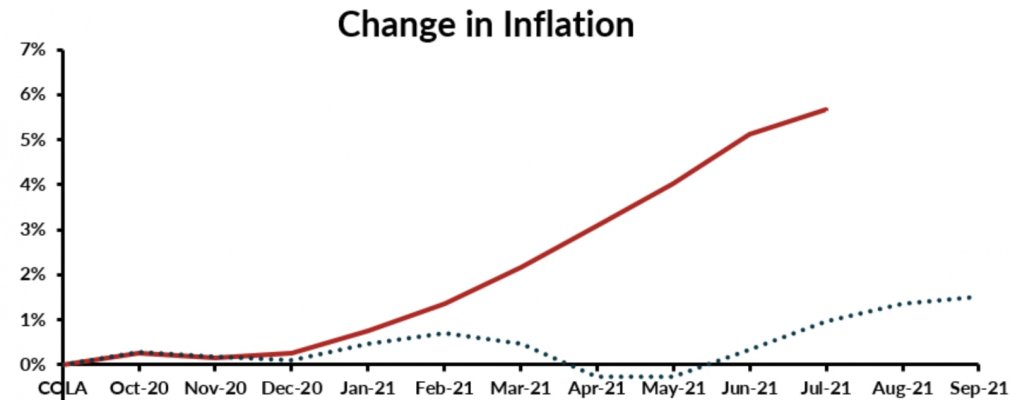

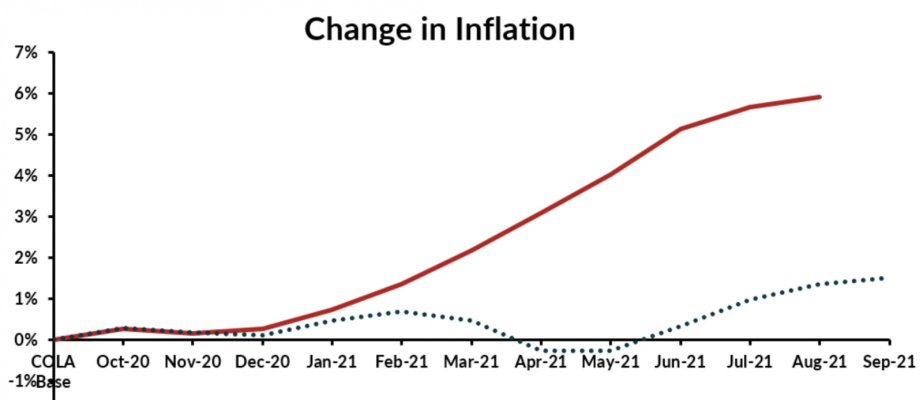

We tried to plan for the possibility of high inflation - refinanced the fixed rate mortgage as rates dropped twice, bought TIPS, have tried to continually lower our fixed expenses each year, and the non-COLA pensions are offset somewhat by the fixed rate mortgage. The pensions won't go up but mortgage won't either. Our house should increase in value. We also don't have a lot of long term bonds. On paper at least, per my modeling, we end up with a higher net worth with high inflation than we would without it.