I buy bonds of corporations based on their operating income, cash flow, interest coverage, and leverage trends (i.e. are they paying back debt) and their coupon.

The rating agencies are not a reliable indicator of default. Look what happened in 2008/9. The rating agencies rated subprime mortgage back securities as AAA and they defaulted. They rated Boeing as A+ and now it's BBB- and is burning through cash every quarter. It should be rated junk. I only buy bonds in corporations in strong sectors from companies with positive cash flow such as Telecom, technology, pharma, and biotechnology and avoid loser sectors such as retail, energy, mining, and industrials. As for the 7.5% coupon bond, take a look at the chart for this corporate note that I have purchased multiple times since 2016 (after the issue date) and always below par:

You bought it when it was a 6 year bond and a 5 year bond and a 4 year bond when the world was coming to an end last year with covid.

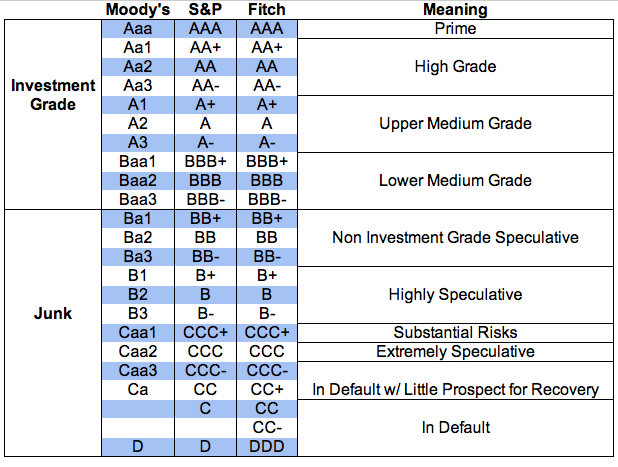

What's going to drive it down 12 points now as a 3 yr bond? This company is highly leveraged and deserves its junk rating.

Bonds Detail

The corporate note dropped below par due to fund selling and quickly recovered. I have seen this pattern for several decades and it is the reason why I always time my bond purchases. I know that blended funds (stocks and bonds) are forced to sell during periods of high redemptions.

What blended funds are holding sub-investment grade debt? So I wait for those events to occur. The other corporate note from Seagate technology (another very profitable company with very strong demand for their products) followed a similar pattern since 2018 after the issue date:

The yield chart on this issue basically tracks the 5 yr treasury, except again when the world was ending from covid. What is going to drive this one year bond below par? Again, I don't know of blended funds that hold junk bonds. BTW Seagate is classified as an industrial, one of those sectors you said you don't like.

Bonds Detail

In the case of Seagate, the company has issued two tender offers for their notes at $104.88 and $103.78 after I bought it below par from those bond funds that sold them to me.

If you think, investment grade bonds are safe, think again. Macy's, Bed Bath and Beyond, Transocean, were at one time investment grade. Look at them now. Bond ratings are a lagging indicator not forward looking. Credit default swap rates (the cost of insuring a bond from default) are better indicators.

Agreed. What is your source for CDS rates?

Here is an example how an investment in a AA+ bond can go south pretty fast. There is nothing wrong with the company Apple, but only a bond fund would buy a 30 year corporate bond with a 2.4% coupon at or over par. Look at it now and only pain lies ahead for the funds that purchased it.

This bond actually performed better than the 30-yr treasury over the same period. Price volatility on 30 yr debt is naturally going to be much higher than on 3 year debt.

Bonds Detail

Passive bond funds buy high and sell low. Their buying and selling decisions are based on inflows and outflows. There is no hunting or waiting for deals. Consider this total loser of a bond fund BND:

https://investor.vanguard.com/etf/profile/BND

It has a yield to maturity of 1.2% and 30 day SEC yield of 1.27%. Who in their right mind would buy that? The YTM of 1.2% is a good indicator that this fund is an expert at buying high and selling low.

Investors buy individual stocks without blinking but bonds from the same companies carry even less risk. I fail to see why people are mystified by individual bonds but not stocks. Bonds are debt obligations. Broad diversification can hurt your performance. Would you lend money to JC Penny, AMC Theaters, Bed Bath and Beyond? Many bond funds did. The people who manage them don't care. It's other peoples money and they collect a fixed fee that has nothing to do with performance.

The one other point I will make is you want to own high yield bonds when the economy is recovering and avoid low yielding investment grade bonds. As rates rise, the low coupon bonds (like the one from Apple) will get destroyed.