You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Investment advice

- Thread starter lawman

- Start date

lawman

Thinks s/he gets paid by the post

What about I Bonds?

I have a lot of I-Bonds...Glad I loaded up on them decades ago!

My buy dates were 2016 (8 year note), 2017 (7 Year), end of 2018 (6 Year Note), 2020 (4 year note). A significant market correction will bring all low yield investment grade and high yield bonds down. GE and Boeing are more leveraged and cash flow negative than this company and yet they are still rated investment grade. You can't rely on rating agencies to decide which bond issue is safe and which isn't. Centurylink (Lumen technology) has been buying back debt and reducing leverage over the past 6 quarters from free cash flow. Netflix is also rated junk, I would buy Neftlix notes before I would buy GE or Boeing notes.

Seagate is a storage technology company not an industrial. Demand for storage is growing and will continue. They are very profitable. Centurylink/Lumen technology is the largest Tier 1 ISP and has the most expansive network in the world. Just about every Tier 2 ISP uses their network and pays a toll. They also provide content delivery through their networks for companies like Netflix. It doesn't take a "world ending event" to cause a sell-off in fixed income. Look back over the past 8 years to see how frequently bonds and preferred stocks have sold off from prices 10-18% over par to 10-20% below par. Last March some exchange traded bonds and preferred stocks sold off as much as 60% below par (I was at the buying end of many of issues). Those same preferred stocks and exchange traded bonds are trading above par.

Market driven CDS rates are a much better indicator of credit quality than rating agencies that have serious conflicts of interest (i.e. they are paid by the companies that issue the bonds/notes). The data is not free but well worth it for managing a bond portfolio.

https://ihsmarkit.com/products/pricing-data-cds.html

You also have to consider the company's financial performance, balance sheets, and industry trends. You can get burned badly by relying on so called "investment grade" ratings from agencies.

https://theconversation.com/why-cre...-still-getting-away-with-bad-behaviour-117549

To give you some idea on just how clueless rating agencies are, read this report from S&P on Advanced Micro Devices from 2016. They rated AMD notes CCC+ after the company announced some of the most revolutionary products to the market. In 2020, S&P rated AMD notes investment grade.

https://www.streetinsider.com/Credi...);+Rates+New+Senior+Conv.+Notes/12010151.html

Any specific reason you avoided WD and chose Seagate ?

Freedom56

Thinks s/he gets paid by the post

Any specific reason you avoided WD and chose Seagate ?

My limit order on WD 4.75% 2026 notes did not fill but my orders for Seagate did fill. Both companies are investable.

BackcountryMe

Dryer sheet wannabe

- Joined

- Feb 20, 2013

- Messages

- 23

My limit order on WD 4.75% 2026 notes did not fill but my orders for Seagate did fill. Both companies are investable.

What brokerage platform do you use for bond investing?

Freedom56

Thinks s/he gets paid by the post

What brokerage platform do you use for bond investing?

I use FINRA/Morningstar to get an idea of bonds are trading at through the trace data. I use Fidelity, Schwab, and TD Ameritrade to execute the trades. TD Ameritrade and Schwab do not let you place limit orders online. Fidelity does to a certain extent. I call the bond trading desks directly most of the time since brokerage firms offer bonds they have in their own inventory only in their online bond screeners. Some bonds have a 250K minimum trade quantity so it pays to call the desk directly to get the closest bid/ask spread.

BackcountryMe

Dryer sheet wannabe

- Joined

- Feb 20, 2013

- Messages

- 23

I use FINRA/Morningstar to get an idea of bonds are trading at through the trace data. I use Fidelity, Schwab, and TD Ameritrade to execute the trades. TD Ameritrade and Schwab do not let you place limit orders online. Fidelity does to a certain extent. I call the bond trading desks directly most of the time since brokerage firms offer bonds they have in their own inventory only in their online bond screeners. Some bonds have a 250K minimum trade quantity so it pays to call the desk directly to get the closest bid/ask spread.

So, your process is to screen for a bond on Morningstar or FINRA and then try to find it at one of the brokers?

What do you screen for and where do you typically set the limit order?

I'd like to begin purchasing individual bonds instead of relying on bond funds, which generally stink.

Freedom56

Thinks s/he gets paid by the post

So, your process is to screen for a bond on Morningstar or FINRA and then try to find it at one of the brokers?

What do you screen for and where do you typically set the limit order?

I'd like to begin purchasing individual bonds instead of relying on bond funds, which generally stink.

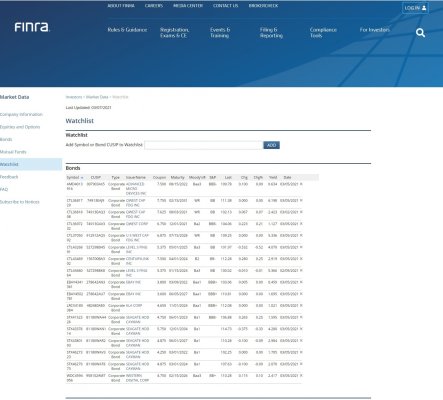

My process starts with finding bonds of companies I want to invest in and then creating a watch list and tracking them (see attached list as an example). I wait for them to drop below par before I start buying. I can screen them using the FINRA Morningstar trace data. With Fidelity you can search for the bond/note by CUSIP number and if it's in inventory, it will show you the bid and ask. You can press the link for the order book to see all the bid and ask prices. You can enter a limit price and quantity online with Fidelity if your limit price is at or above the lowest bid price in their order book and wait for your order to fill. If you want to enter a limit price below the lowest bid price, you have to call the bond desk. If the bond/note is not in inventory, you have to call the bond desk or in my case I check with TD Ameritrade and Schwab to see if they have the security in inventory before calling the bond desk.

I research the companies before buying. My objective is to buy securities with the highest YTM with lowest risk of default to maturity. I listen to company earnings conference calls and review their SEC filings. There really is no bond research to speak of and most of the free equity research that you get from Fidelity, Schwab, and TD Ameritrade are generated by BOTs (you get what you pay for). I avoid loser companies in perennially loser sectors such as airlines, retail, malls, oil and gas, industrials, MLPs, and companies that fail to generate positive cash flow. That alone reduces my risk significantly. I always time my purchase which requires a lot of patience and discipline. But I have a ladder with maturities out to 2031 so income is always flowing in. I rarely buy bonds/notes with terms greater than 11 years. Most are in the 1 to 7 year range. I normally hold my bonds/notes to maturity unless the YTM drops below prevailing money market rates or an event associated with the company causes me to re-assess the risk of holding their securities to maturity.

Attachments

US I Savings Bonds

Although you can now buy only $10,000 a year of US I savings bonds (though there’s a special way to buy another $5000 by overpaying your federal tax), you might want to research them and consider laddering them like CDs over time. They’re free from state tax, your principal is guaranteed, and they keep up with the CPI, so they may end up paying more in interest than we’ve been able to get in a while. If you anticipate having children who will be going to college or university, the bonds can be used to pay for their qualified educational expenses tax-free.

You cannot trade them like most bonds. There are some restrictions on cashing them which are described below:

https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds.htm

US E Savings Bonds can also be a good investment if you can plan on holding them for exactly 20 years, at which point they will double in value. Otherwise, the fixed interest rate has been too low.

I have $100,000.00 cash in a savings account I want to invest. I am looking for 2% - 3% return and want a conservative investment..I'm thinking intermediate term corporate bond fund but I don't know how to research them..Are there other options? What funds are good and what are their symbols?

Although you can now buy only $10,000 a year of US I savings bonds (though there’s a special way to buy another $5000 by overpaying your federal tax), you might want to research them and consider laddering them like CDs over time. They’re free from state tax, your principal is guaranteed, and they keep up with the CPI, so they may end up paying more in interest than we’ve been able to get in a while. If you anticipate having children who will be going to college or university, the bonds can be used to pay for their qualified educational expenses tax-free.

You cannot trade them like most bonds. There are some restrictions on cashing them which are described below:

https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds.htm

US E Savings Bonds can also be a good investment if you can plan on holding them for exactly 20 years, at which point they will double in value. Otherwise, the fixed interest rate has been too low.

Similar threads

- Replies

- 40

- Views

- 3K

- Replies

- 20

- Views

- 756

Latest posts

-

-

-

-

-

-

What OLD series/movies are you watching? *Spoilers welcome!*

- Latest: RetiredAndLovingIt

-

-

Latest Inflation Numbers and Discussion

- Latest: Teacher Terry