If you have "a lot" in the market you have to expect up and down years. Stay the course!

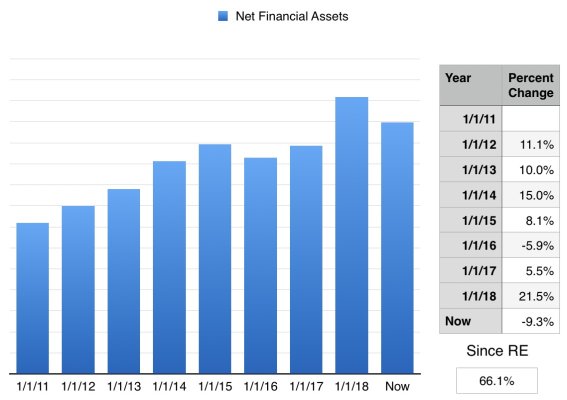

Here are our results since 1/1/11 when I FIREd. You'll see this is the second down year. We feel pretty blessed to be up 66% since I retired - even after all our spending. Note we track our financial assets - excluding the house we live in. No Pension, no SS for many years to come.

Older thread, but I thought this particular response and chart was somewhat reassuring for those of us who retired this year and are reliant on their portfolios to cover their spend. Personally, despite having a plan that anticipated a high probability of a down market this year, it still psychologically messes with you (at least me) when I see my portfolio balance drop multiple times relative to my planned spend. I find I am having a harder time giving myself permission on some "extra spend" despite having a WR around 2.5% based on today's current balance. Funny, if I re-retire today, everything feels hunky-dory. Interesting how we can interpret our numbers to either pull in the reigns or loosen them up.