It's due to Bedford's Law, A.K.A. "First-Digit Law".

To get from 100 to 200, you have to double (i.e. 100% gain).

To get from 200 to 300, you only have to "half again" (i.e. 50% gain).

To get from 300 to 400, takes 33% gain.

... etc...

To get from 900 to 1000, takes only 11% gain.

Then you start all over again, buidling up from 1000 to 2000.

So the good news for the OP is that it gets faster from here -- until you hit $1M.

To get from 100 to 200, you have to double (i.e. 100% gain).

To get from 200 to 300, you only have to "half again" (i.e. 50% gain).

To get from 300 to 400, takes 33% gain.

... etc...

To get from 900 to 1000, takes only 11% gain.

Then you start all over again, buidling up from 1000 to 2000.

So the good news for the OP is that it gets faster from here -- until you hit $1M.

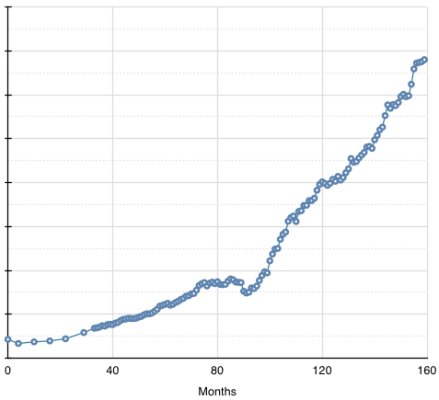

. I'll believe you...I want our NW to keep trucking up. Now, more seriously, is this your as one-person's portfolio? If so, you've done great. We have similar trajectory of growth as yours, but with dual income (and two kiddos

. I'll believe you...I want our NW to keep trucking up. Now, more seriously, is this your as one-person's portfolio? If so, you've done great. We have similar trajectory of growth as yours, but with dual income (and two kiddos