our plan includes some assumptions for some explicit declines in spending compared to today. My spreadsheet has 1) today's expense rate, 2) when we sell big home and move in a few years, 3) when the kids are out of college and indepdendent 4) when we are 70 and SS/Medicare/RMDs kick in (I know medicare kicks in before 70 but just used 70 to simplify.

Do you pro-forma model reduced expenses in the future or is that too risky?

Some of the bigger $ examples

- property taxes, mortgage, upkeep expenses on our big primary home which we will sell once the kids are all away @ college. Assuming smaller home expenses.

- reduced cost of health and auto insurance when kids are off our plans in mid 20's

- reduced groceries and other expenditures when no longer have three teen boys @ home

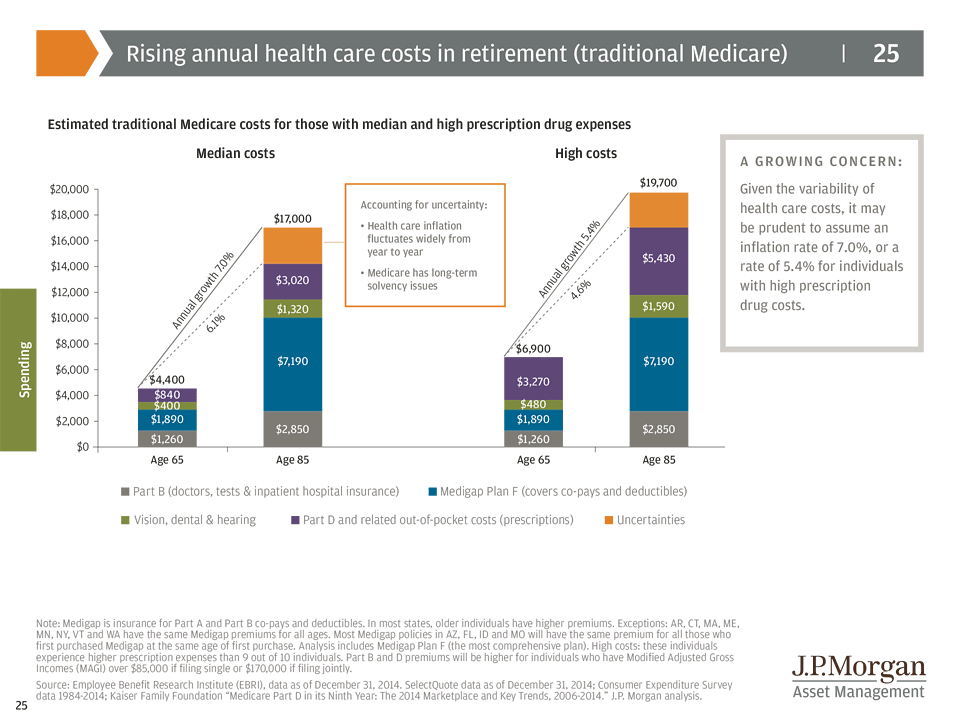

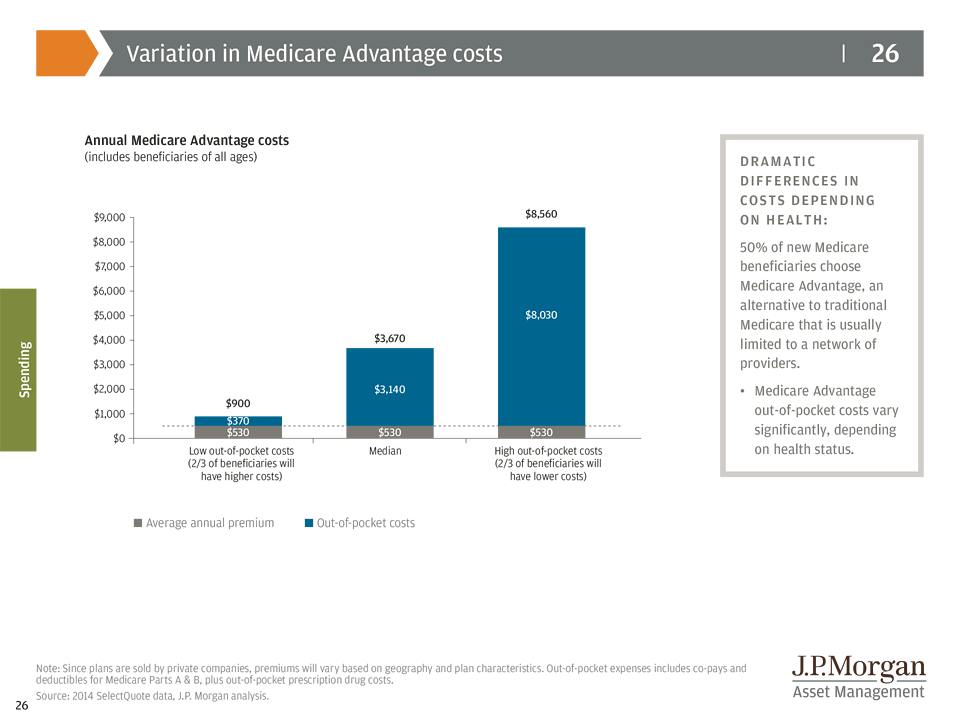

- medicare vs private health care

Do you pro-forma model reduced expenses in the future or is that too risky?

Some of the bigger $ examples

- property taxes, mortgage, upkeep expenses on our big primary home which we will sell once the kids are all away @ college. Assuming smaller home expenses.

- reduced cost of health and auto insurance when kids are off our plans in mid 20's

- reduced groceries and other expenditures when no longer have three teen boys @ home

- medicare vs private health care