ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

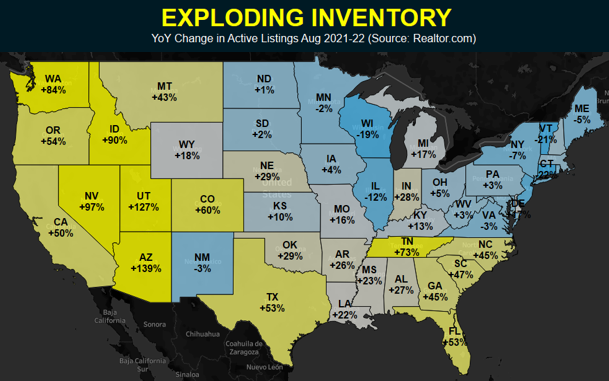

Here's data:

https://fred.stlouisfed.org/series/MEDDAYONMARUS#

Those are days from listing to close, so time to close throws a variable in there. According to that, recent months were the 'hottest'. I would have thought things were hotter 12~18 months ago (we were buying/selling early 2021, and things were crazy - our house never even got listed, we had a buyer just about begging for our house).

-ERD50

https://fred.stlouisfed.org/series/MEDDAYONMARUS#

Those are days from listing to close, so time to close throws a variable in there. According to that, recent months were the 'hottest'. I would have thought things were hotter 12~18 months ago (we were buying/selling early 2021, and things were crazy - our house never even got listed, we had a buyer just about begging for our house).

-ERD50