You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Is the realestate bubble bursting?

- Thread starter 2HOTinPHX

- Start date

copyright1997reloaded

Thinks s/he gets paid by the post

ncbill

Thinks s/he gets paid by the post

I've advised my kid who wants a house to start looking seriously this fall into winter.

I might even write a private mortgage so I can collect his $ instead of a bank.

I might even write a private mortgage so I can collect his $ instead of a bank.

Winemaker

Thinks s/he gets paid by the post

Closed on Mom's house two weeks ago, for a premium over listing price. It was on the market for 18 hours and sold 6 hours into the Open House. Dad and Mom would have been pleased; the house was in the South Hills of Pittsburgh. Not slowing here, IMHO.

When Mom and Dad sold their last house in 1979 to buy this one, Dad spent more time painting the For Sale sign than it took to sell it. Dad was putting the sign in the ground when friends of a neighbor came over and bought it for cash.

When Mom and Dad sold their last house in 1979 to buy this one, Dad spent more time painting the For Sale sign than it took to sell it. Dad was putting the sign in the ground when friends of a neighbor came over and bought it for cash.

copyright1997reloaded

Thinks s/he gets paid by the post

Closed on Mom's house two weeks ago, for a premium over listing price. It was on the market for 18 hours and sold 6 hours into the Open House. Dad and Mom would have been pleased; the house was in the South Hills of Pittsburgh. Not slowing here, IMHO.

When Mom and Dad sold their last house in 1979 to buy this one, Dad spent more time painting the For Sale sign than it took to sell it. Dad was putting the sign in the ground when friends of a neighbor came over and bought it for cash.

I have relatives in that area and was born there. I've on and off looked at housing there over the years after moving away. For a long time, housing was really inexpensive there. Recently, housing has been super tight in the South Hills. Having said that, I think you sold at the right time. Five years ago things were not like this at all, and I don't think it will be that way a year or two from now.

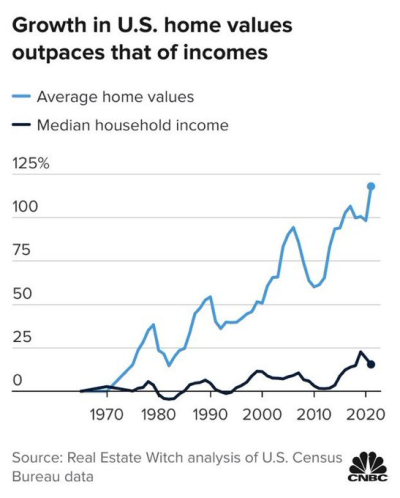

RE prices usually drop during recessions. The deeper recession, the lower prices. However, currently with the high inflation many people are looking to invest in order to save / protect their money. From my monitoring of prices over 32 years, it is going down only temporary during economic down time and it is time to purchase. On a long run it is going up due to the inflation.

aja8888

Moderator Emeritus

Wolf Street report for "April"...

Easy read and Wolf shows what's going on in the big cities. Note that data is thru April as May is not published yet. Commentors have boots on the ground actual observations in some cities like Las Vegas, etc.

So it behooves you to read the comment section.

https://wolfstreet.com/2022/06/28/t...ing-point-of-the-raging-mania/#comment-445990

Easy read and Wolf shows what's going on in the big cities. Note that data is thru April as May is not published yet. Commentors have boots on the ground actual observations in some cities like Las Vegas, etc.

So it behooves you to read the comment section.

https://wolfstreet.com/2022/06/28/t...ing-point-of-the-raging-mania/#comment-445990

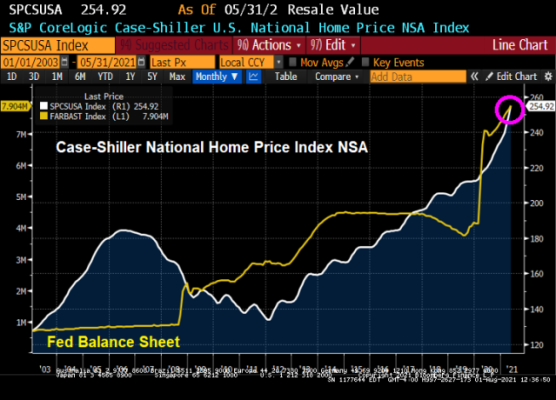

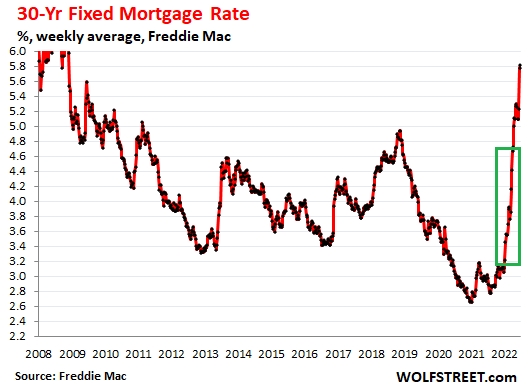

:The first “deceleration” and “signs of a tipping point” cropped up in the S&P CoreLogic Home Price Index, which was released today. But today’s data for “April” consists of the three-month average of closed home sales that were entered into public records in February, March, and April, representing deals that were made a few weeks earlier, roughly in January, February, and March, funded with mortgage rates prevalent at that time and earlier for home buyers with pre-approved mortgages with rate locks when they were pre-approved, so roughly based on the mortgage rates prevalent in December through March, ranging from 3.2% to 4.7% (green box)

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

Real estate prices are sticky and people won't sell unless they have to. In the 2009 GFC, it took two years for prices to bottom. We bought our second home at that time and paid $62/sq. ft. for it (3 year old 2,000 sq. ft. brick ranch in Spring, TX). It sold new for around $200,000 in 2007.

Once mortgage rates go higher with increased fed funds rate increases, there will be less people who will be able to afford a mortgage and prices of homes will fall to accommodate those higher rates.

It does this in cycles and it's no mystery.

Aja, I will never be able to buy anything again, because you will have to pry my 2.75% note from my cold dead hands, ha.

I spoke to a realtor I know today. At least around here, it's happening. Three showings in the past week. Nobody came to one of them. Just a few to the other two. No offers. Virtually nobody is buying. Houses are staying on the market longer and longer. Inventories are up.

This particular guy is predicting a real impact when foreclosures start to ramp up, but admittedly he's been saying that for a while now. I'm don't think we're going back to a 2008 situation, but he does know his market.

This particular guy is predicting a real impact when foreclosures start to ramp up, but admittedly he's been saying that for a while now. I'm don't think we're going back to a 2008 situation, but he does know his market.

aja8888

Moderator Emeritus

Aja, I will never be able to buy anything again, because you will have to pry my 2.75% note from my cold dead hands, ha.

You better hang on to that note! I doubt very much if anyone will see rates that low again for many years.

Good point about selling/buying in the same market. If your purchase price is lower wouldn't your property taxes also start out lower in most places right? So that could be a possible silver lining, after all property taxes are forever.

Fortunately for us, prop 13 and it's add on's - property tax is not a concern. Our current house was purchased from my dad. And we were able to transfer his super low prop 13 tax rate. Then when we move, we can transfer it again because we're over 55. But that will be the last transfer of the low rate.

Most non-seniors, pay more in taxes when they change homes in CA because their taxes reset to market rate vs the prop 13 rate.

aja8888

Moderator Emeritus

Most non-seniors, pay more in taxes when they change homes in CA because their taxes reset to market rate vs the prop 13 rate.

That's probably why a lot of retirees are cashing out, downsizing, and moving out of CA to places like Nevada, Arizona, Texas and Florida (and other states).

skyking1

Thinks s/he gets paid by the post

^ that is true. Our property value went up ~18% this year. We could get some senior assistance, @ a maximum of 43K income a year. We don't have that kind of retirement.

I've advised my kid who wants a house to start looking seriously this fall into winter.

I might even write a private mortgage so I can collect his $ instead of a bank.

My DF did this for me when I bought my first townhome. Why pay the bank a dime more than you need to. Keep the wealth in the family.

The house next to me has been on the market for multiple days with no offer review date. Six months ago it would have already been pending with multiple offers.

I bought my place in late 2019, which is similar to the house for sale. If I was to buy now, my monthly costs would be ~$4000/month vs $2800 (assuming a 5% mortgage).

This type of place rents for ~$3000/month, maybe a little bit more. Buying it for an investment doesn’t make sense anymore.

I’m curious to see how long it takes to sell. Houses are still selling, but talking with a realtor friend, they’re selling at list price, there aren’t multiple offers, and inventories are increasing.

Might be a good time to be a buyer soon.

I bought my place in late 2019, which is similar to the house for sale. If I was to buy now, my monthly costs would be ~$4000/month vs $2800 (assuming a 5% mortgage).

This type of place rents for ~$3000/month, maybe a little bit more. Buying it for an investment doesn’t make sense anymore.

I’m curious to see how long it takes to sell. Houses are still selling, but talking with a realtor friend, they’re selling at list price, there aren’t multiple offers, and inventories are increasing.

Might be a good time to be a buyer soon.

Teacher Terry

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 17, 2014

- Messages

- 7,084

That's probably why a lot of retirees are cashing out, downsizing, and moving out of CA to places like Nevada, Arizona, Texas and Florida (and other states).

Californians have been retiring to Reno in droves. Besides the no state income tax our property taxes are extremely low. The formula takes the age of the home into consideration so the older your house the less taxes you pay.

For instance the property taxes on the house I sold last year for 400k were only 720/year. My friends in Wisconsin have suggested I move back but besides not liking the weather property taxes would take a big bite out of my budget despite property being cheaper.

2HOTinPHX

Full time employment: Posting here.

Wow low property taxes nice! Get ready were all coming to Vegas!Californians have been retiring to Reno in droves. Besides the no state income tax our property taxes are extremely low. The formula takes the age of the home into consideration so the older your house the less taxes you pay.

For instance the property taxes on the house I sold last year for 400k were only 720/year. My friends in Wisconsin have suggested I move back but besides not liking the weather property taxes would take a big bite out of my budget despite property being cheaper.

aja8888

Moderator Emeritus

Californians have been retiring to Reno in droves. Besides the no state income tax our property taxes are extremely low. The formula takes the age of the home into consideration so the older your house the less taxes you pay.

For instance the property taxes on the house I sold last year for 400k were only 720/year. My friends in Wisconsin have suggested I move back but besides not liking the weather property taxes would take a big bite out of my budget despite property being cheaper.

My SIL and husband live in Tomahawk, WI and come to Texas every winter to visit. Then they drive over to California to visit other relatives and return to WI in the Spring. They love Wisconsin but the winters are getting to them.

ncbill

Thinks s/he gets paid by the post

Fortunately for us, prop 13 and it's add on's - property tax is not a concern. Our current house was purchased from my dad. And we were able to transfer his super low prop 13 tax rate. Then when we move, we can transfer it again because we're over 55. But that will be the last transfer of the low rate.

Most non-seniors, pay more in taxes when they change homes in CA because their taxes reset to market rate vs the prop 13 rate.

I've always wondered back when Prop 13 was first passed how many homeowners were smart enough to move their home from their individual name(s) to a company name.

Then just transfer the company stock when selling so any new owner keeps the tax basis...e.g. 1234 Main Street has remained owned by "ACME Properties, Inc." since 1978.

Teacher Terry

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 17, 2014

- Messages

- 7,084

Aja, Tomahawk Wisconsin is farther up north so definitely colder than Kenosha and they get a lot more snow. Winters aren’t a big deal when younger but really suck in old age.

aja8888

Moderator Emeritus

Aja, Tomahawk Wisconsin is farther up north so definitely colder than Kenosha and they get a lot more snow. Winters aren’t a big deal when younger but really suck in old age.

I worked for the American Brass in Kenosha and it gets pretty cold with the lake effect. Maybe not as much snow though as Tomahawk.

Trailwalker

Full time employment: Posting here.

- Joined

- Mar 19, 2021

- Messages

- 624

I worked for the American Brass in Kenosha and it gets pretty cold with the lake effect. Maybe not as much snow though as Tomahawk.

We love the seasons in Wisconsin--we just wish they were more evenly weighted. Winters drag on for much longer than three months. Property taxes here are high, but it's evened out some by relatively lower sales taxes (5.5% for state and local).

To the thread, I'm seeing more properties go on the market in our local area, and they aren't selling quickly. For awhile, it was nuts. My new neighbor paid twice what the house sold for five years ago. My house is getting reassessed this summer, and it's going to look like a crazy number. I hope the mill rate drops accordingly.

Katsmeow

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 11, 2009

- Messages

- 5,308

Californians have been retiring to Reno in droves. Besides the no state income tax our property taxes are extremely low.

We are hoping to move from Texas to Las Vegas. One of our criteria for moving was looking at taxes. Of course, Texas doesn't have state income taxes but property taxes are high. Texas does provide a freeze for some taxes if you are over 65. Our school taxes are frozen so we pay a lot less than we would pay if we didn't have that exemption. However, if you move to Nevada our taxes well be far lower even though they won't have that cap.

Teacher Terry

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 17, 2014

- Messages

- 7,084

The low taxes have been helpful to me in retirement. Aja, Kenosha can be down right balmy compared to northern Wisconsin ). I really miss walking by Lake Michigan daily.

). I really miss walking by Lake Michigan daily.

Similar threads

- Replies

- 21

- Views

- 3K