BubbaChris

Recycles dryer sheets

We didn’t plan to ER this year, but my DW did in March and I’m just over a week away from my last day. We’re both 60 and our top financial priority is to maintain our ACA Premium Tax Credits. Having extremely affordable healthcare is the main catalyst behind being able to ER.

My living life priority is to set things up so number crunching isn’t a weekly or even a monthly activity. I intend to lay out a strategy and supporting tactics, then sleep well at night. I will manage our taxes with an eye towards the future, yet a 2%-3% difference in estimated estate value at death isn’t worth jumping through many hoops.

I had not been studying FIRE until a handful of months ago, and I first want to strategize on where I’m pulling our living expenses from until we hit 65. Our balance sheet is 30% after-tax, 60% tIRA, 10% ROTH. We have money market accounts which could cover 3.3 years of our low budget or 2.5 years of our high budget.

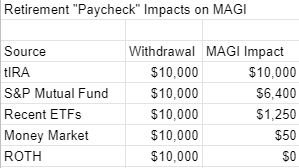

One of the take-away’s I have from reading through about a dozen MAGI threads here is how LTCG is great from a tax viewpoint, but not given special treatment for MAGI. And because one-third of my after-tax account is in an S&P 500 mutual fund that we’ve held for decades, my cost basis on those shares is only 36% of the current market value. My more recently purchased ETFs have an average cost basis around 87% of current value.

At this point our “income” for the next handful of years will come from a combination of tIRA, ETF, and Money Market withdrawals. ETF withdrawals will carry the biggest chunk, with tIRA being used with the goal of mildly shrinking my RMDs down the road. Between age 65 and taking SS, the S&P MF will become primary. Here’s a chart I’m using to visualize the impact from each source. ROTH will likely only be tapped if we have a sudden large expense (home repair).

Does this approach resonate with anyone else in their ACA years?

Best regards,

Chris

My living life priority is to set things up so number crunching isn’t a weekly or even a monthly activity. I intend to lay out a strategy and supporting tactics, then sleep well at night. I will manage our taxes with an eye towards the future, yet a 2%-3% difference in estimated estate value at death isn’t worth jumping through many hoops.

I had not been studying FIRE until a handful of months ago, and I first want to strategize on where I’m pulling our living expenses from until we hit 65. Our balance sheet is 30% after-tax, 60% tIRA, 10% ROTH. We have money market accounts which could cover 3.3 years of our low budget or 2.5 years of our high budget.

One of the take-away’s I have from reading through about a dozen MAGI threads here is how LTCG is great from a tax viewpoint, but not given special treatment for MAGI. And because one-third of my after-tax account is in an S&P 500 mutual fund that we’ve held for decades, my cost basis on those shares is only 36% of the current market value. My more recently purchased ETFs have an average cost basis around 87% of current value.

At this point our “income” for the next handful of years will come from a combination of tIRA, ETF, and Money Market withdrawals. ETF withdrawals will carry the biggest chunk, with tIRA being used with the goal of mildly shrinking my RMDs down the road. Between age 65 and taking SS, the S&P MF will become primary. Here’s a chart I’m using to visualize the impact from each source. ROTH will likely only be tapped if we have a sudden large expense (home repair).

Does this approach resonate with anyone else in their ACA years?

Best regards,

Chris

Attachments

Last edited: