oscar1

Recycles dryer sheets

- Joined

- Jul 25, 2013

- Messages

- 140

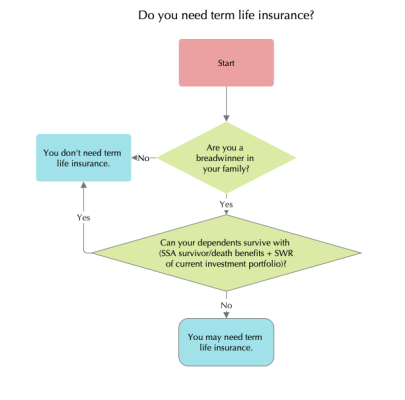

DW 64, me 61. My 20-yr $500k term policy expires next month. It served its purpose. Our investments should carry us perpetually as long as we don’t get crazy buying new houses, cars, extravagant life style. Males in our family can make 80’s but 90’s would be a stretch. Our only daughter will inherit a decent legacy of several million. Should I renew for another 20 years term for ~$50k over that time period or just let it go? Seems like a $50k gamble to make $500k might make sense?