pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Here my complexities which I assume many others have.

I don't need any income.

I want to do maximum Roth conversions before I turn 72 yrs old.

I want my younger wife to get my maximum SS benefit when I'm gone.

I have not run any analysis, but these 3 items make me think I should wait until 70. My wife is 5 years younger, I don't know whether delaying hers will help us keep Roth converting in a low tax bracket or not. I expect about $32k of SS at 70, not including COL adjustments over the next 4 years.

Do any of the programs use these type of complexities in their calculations?

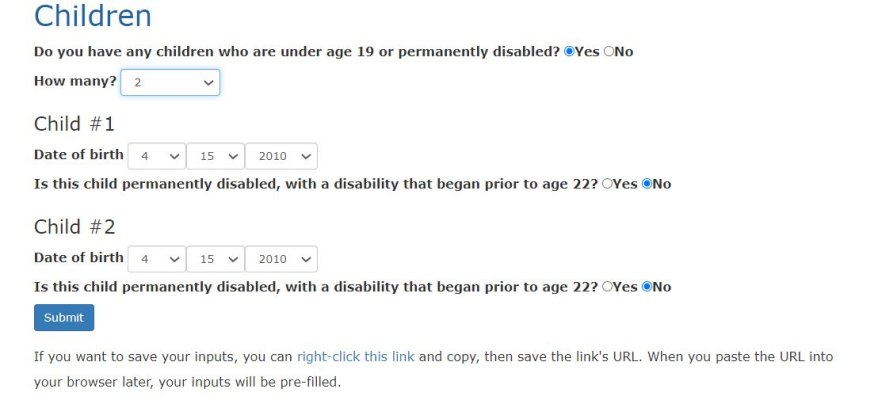

opensocialsecurity.com uses the third one.

I am with you... we don't need the income and the longevity insurance might be helpful... and I definitely want to mazimize Roth conversions and taking SS early gets in the way of that.

That said, as excited that we tend to get about SS in our case the decision isn't life changing looking at the range of expected present values... just a bit of tweaking for optimization.