Romer

Recycles dryer sheets

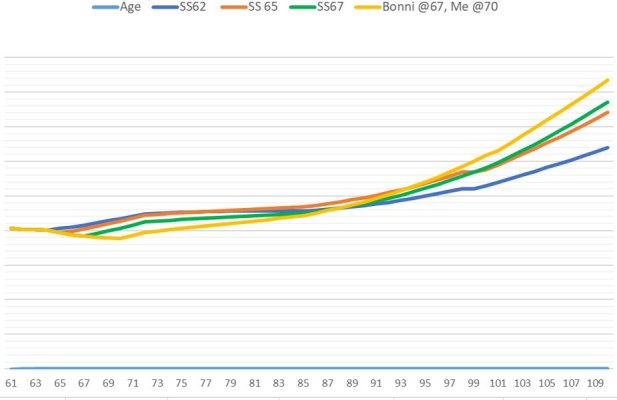

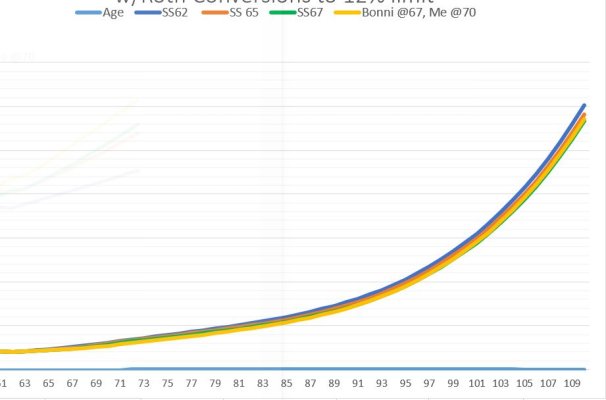

I should add if I change the ROI to 4% the difference between the options becomes smaller and as you can see it doesn't really matter when I take it. I can only spend so much money

That is the only variable I changed and now 65 isn't the sure winner. 62 and 65 are close, but 70 is still the best starting in the mid 90's which I think is to far out to count on for now

I did also model for my wife if I were to pass and she will be fine in any scenario

Edit- posted the wrong curve. Corrected

That is the only variable I changed and now 65 isn't the sure winner. 62 and 65 are close, but 70 is still the best starting in the mid 90's which I think is to far out to count on for now

I did also model for my wife if I were to pass and she will be fine in any scenario

Edit- posted the wrong curve. Corrected

Attachments

Last edited: