i didn't read all of your post.

But, Lets beat this thing to death...

Why the 16X model doesn't work so well. It doesn't account for different collection spans. Therefore some sort of correction need be added to compare

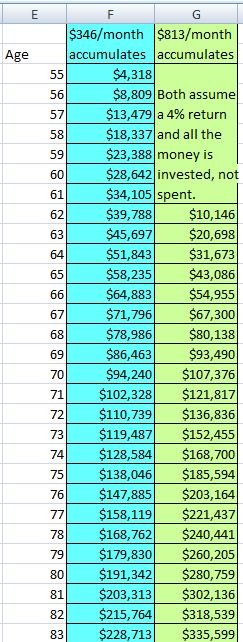

lets suppose the 62 year old lives to 82. That's 20 years of pension he gets. We estimated the presnt value of his pension at 62 to be around $156k. And we discounted it back to 55 estimeted at $111k.

The 55 year old also lives to 82 which is 27 years of pension. Here the 16X model underestimates relative to the 62 year old (16X model) by 7 years. The $29k extra was an attempt to correct the model.

This is a correction above and beyond, the 16X discounted cash flow.

maybe you should have read all my post. let me now show you why you dont have to discount twice (of course you will need to read this post). first, you are correct about the need to correct for time but all i am saying is you dont need to correct twice (in fact doing so makes the comparison incorrect). i will show you with both of the ways i said you could account for the difference in when the payments start. it is conceptually easier to explain by comparing the value of the 2 pensions at the age of 62. to get the value of all the payments going forward for each pension at the age of 65 we use the same formula (i.e. 16x). thats fair, right? those values, as pointed out by you, are

The present value of your ($346/mo) pension using the 16x formula is

12X346X16 = 66432

.... the $813 pension is

12X 813X16 = 156096.

value of pension A = $66,432

value of pension B = $156,096

any problem so far? remember we are determining the value of these pensions at age 65. but what about all those payments already made? well seems like they need to be added to the above values. i will again use your numbers.

The 55 year old gets 7 more years of income than the 62 year old. The 55 year old gets an extra 7 years X 12 months/year X 346 ==> $29064 extra.

so making that addition we get

value of pension A = $66,432 + $29,064 = $95,496

value of pension B = $156,096 + 0 = $156,096

(which i said in my 1st post and showed in my 3rd post, the 1 you didnt read.) remember these are the values of both pensions at age 62

now if you want the values of both pensions at age 55 you need to discount the values of

both pensions soo using your work in that area too

But that value needs to be discounted at (lets say for example) 5% per year. IE. How much money do I need now that compounds at 5%/yr will give me 156096.

using a 5% discount rate for 5 years I get that the present value of the income stream at 62 is ~$111k

we see that discounting a cash flow value from the value it has age 62 to its value at age 55 (7 years) using your assumed discount rate of 5% we can multiply its value at age 62 by ~0.711 ($156,096*0.711=~$111,000). there is the value of 1 pension but the value of the other 1 at age 62 also needs to be discounted (we need to be consistant) so it becomes $95,496*0.711=~$67,898. now this last paragraph is a convoluted way of arriving at the value of pension A at the age of 55 but i did this to be consistant. it does show that the 16x formula isnt consistant with a 5% discounting but that isnt really the point.

the point i am trying to make is when you discounted pension B using 5% you got the value of pension B at age 55 (and that is all you needed to do because you already had the value of pension A at age 55) but when you added all the payments made from pension A to the 16x formula for that pension you had the value of pension A at age 62 (not age 55). in essence you double discounted and as such you were comparing apples to oranges. you need to pick 1 date to which you calculate the value of both pensions, not compare values at different dates.

and oh btw, instead of beating this to death how bout you read my posts before commenting on them?