FYI I cut and pasted the counties with the highest Debt to GNP ratio. USA's Debt to GNP has been increasing over the years which I find alarming. I do not want the USA to be associated with Japan, Italy, Greece and Portugal which all have slow national economic growth......

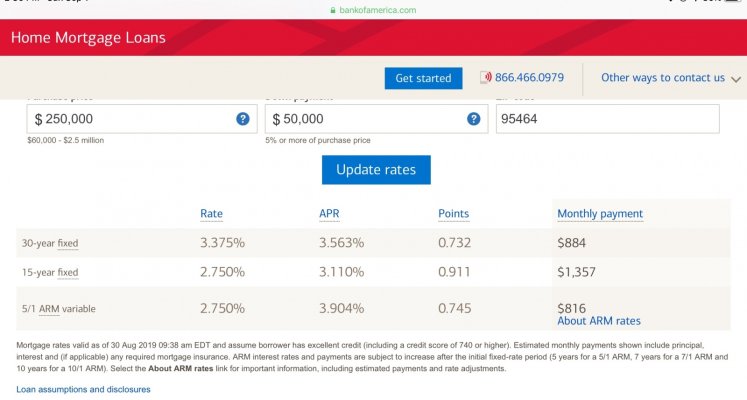

My point: With a huge national debt, USA does not have many options to spend itself out of a recession and therefore low interest rates are here to stay for a long time.

///////////////////////////////////////////////////////////////

What countries have the largest debt in the world? Here is a list of the top ten countries with the most national debt:

- Japan (National Debt: ¥1,028 trillion ($9.087 trillion USD))

- Greece (National Debt: €332.6 billion ($379 billion US))

- Portugal (National Debt: €232 billion ($264 billion US))

- Italy (National Debt: €2.17 trillion ($2.48 trillion US))

- Bhutan (National Debt: $2.33 billion (USD))

- Cyprus (National Debt: €18.95 billion ($21.64 billion USD))

- Belgium (National Debt: €399.5 billion ($456.18 billion USD))

- United States of America (National Debt: $19.23 trillion (USD))

- Spain (National Debt: €1.09 trillion ($1.24 USD))

- Singapore (National Debt: $350 billion ($254 billion US))

Japan, with its population of 127,185,332, has the highest national debt in the world at 235.96% of its GDP (although, notably, Japan is also one of the world's largest economies). This is followed by Greece, which is still recovering from the effects of its economic crisis and subsequent bailout, at 191.27%.

Venezuela, which is currently undergoing serious economic difficulties, is also in the top five countries with the highest national debt, with a debt to GDP ratio of 161.99%. Several African countries also have high national debts, including

Sudan (176.49%),

Eritrea (129.43%) and

Gambia (111.45%).

Of the world's major economic powers, the United States has the highest national debt at 108.02% of its GDP.

China, the world's second-largest economy and home to the world's largest population (1,415,045,928), has a national debt ratio of just 51.21% of its GDP.

Germany, as

Europe's largest economy, also has a relatively low national debt ratio at 59.81%.

Hong Kong, a major global financial center, has the lowest national debt in the world, at just 0.05% of its GDP. This is followed by the tiny Kingdom of

Brunei with a population of just 434,076 and a national debt of 2.49% of its GDP

IMF data from the April 2018

IMF World Economic Outlook database.