REWahoo

Give me a museum and I'll fill it. (Picasso) Give

It was one year ago today (Dec 1) when Sue J posted Penfed's offer of 5yr CDs with a rate of 3%: http://www.early-retirement.org/forums/f28/new-at-penfed-3-5yr-certificates-69476.html

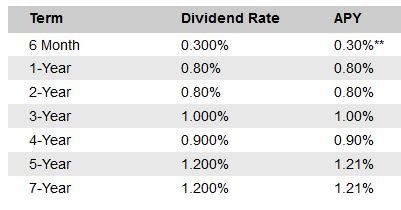

Doesn't appear they will offer anything close to that again - at least not yet:

Doesn't appear they will offer anything close to that again - at least not yet: