- Joined

- Jul 1, 2017

- Messages

- 5,802

A calculator I use in conjunction with Firecalc that I really like is called Rich Dead or Broke. It allows you to input a spending flex percentage thus allowing the spending amount in your plan when necessary to flex based upon the percentage set thereby increasing the likelihood of success for your plan.

In our case the biggest flex amounts in our budget are travel and dining out, which combined make up a healthy double digit percentage of our spending. If there were a market retreat or say even a pandemic, needless to say our spending would and has adjusted accordingly, which obviously affects the success rate of the plan, as opposed to say having a constant rigid withdrawal amount over the life of the plan.

Like Firecalc It also has the functionality to layer in other income or expense streams and apply beginning and ending dates to each of those streams. Additionally it brings in the death component to our planning which can also be eye-opening.

I use it and Firecalc in conjunction with my own spreadsheet in my routine financial planning and review. The link is provided below. See what you think...

https://engaging-data.com/will-money-last-retire-early/

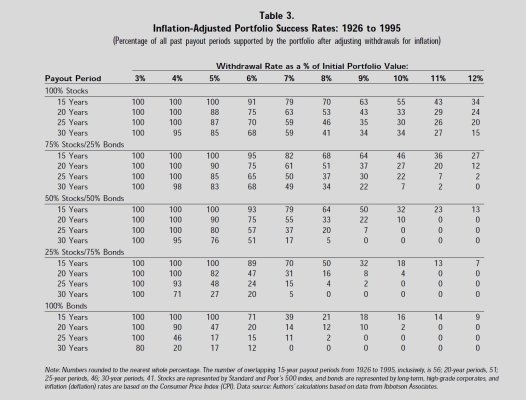

Maybe I'm reading it wrong, but at the default setting lump sum with a 4% withdrawal, it doesn't provide a 100% success rate for 30 years.