I need some help understand Roth Withdrawal rules and order.

1. I'm 52, so taking them out pre-59.5

2. I have had a Roth IRA open for decades so I'm over the 5 year rule

3. I have both Roth IRA and Roth 401k

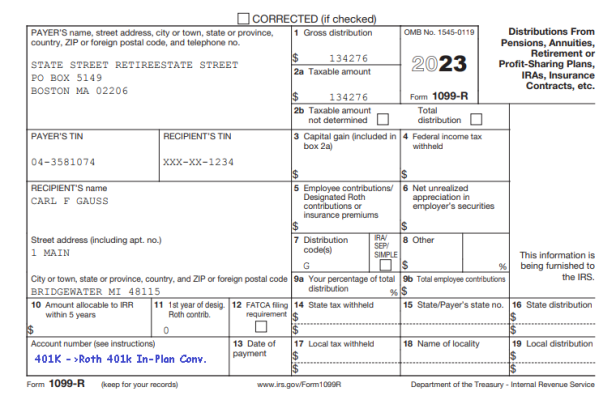

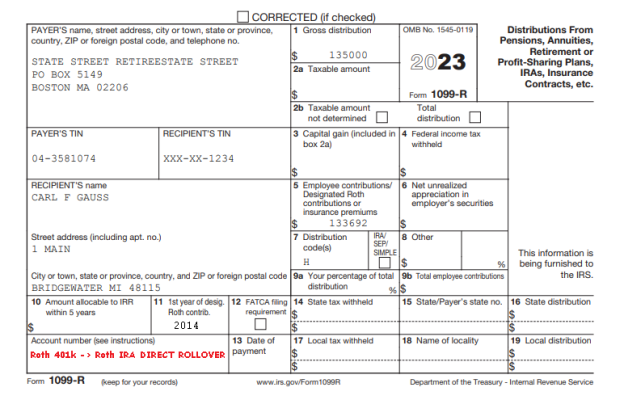

No longer worker so plan to roll 401k plan into Roth IRA and this is where I'm not sure what the rules are.

1. I know I can take out anything I contributed to my Roth IRA and I have that tracked

2. I know I can take out anything I converted more than 5 years ago and that is tracked and it has to come out after #1.

3. Gains are locked until 59.5 unless I want to pay tax/penalty

But what about the Roth 401k money that would now be in my Roth IRA?? Is any of that money able to be withdrawn tax and penalty free before 59.5?

I get gains are gains, so those fall into #3, but the 401k contributions?? which bucket do those fall into once rolled over?

1. I'm 52, so taking them out pre-59.5

2. I have had a Roth IRA open for decades so I'm over the 5 year rule

3. I have both Roth IRA and Roth 401k

No longer worker so plan to roll 401k plan into Roth IRA and this is where I'm not sure what the rules are.

1. I know I can take out anything I contributed to my Roth IRA and I have that tracked

2. I know I can take out anything I converted more than 5 years ago and that is tracked and it has to come out after #1.

3. Gains are locked until 59.5 unless I want to pay tax/penalty

But what about the Roth 401k money that would now be in my Roth IRA?? Is any of that money able to be withdrawn tax and penalty free before 59.5?

I get gains are gains, so those fall into #3, but the 401k contributions?? which bucket do those fall into once rolled over?