BOBOT

Recycles dryer sheets

- Joined

- Aug 17, 2006

- Messages

- 478

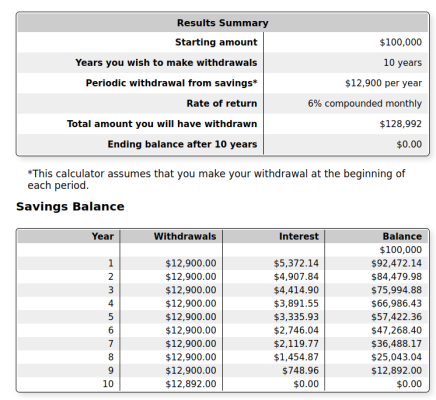

DW has an inherited IRA, & we're trying to figure how to comply with and implement the 10 year rule for liquidating it. Many unknowns, of course, including future returns, tax rates, etc., others we haven't thought of.

A spreadsheet sort of analysis tool would help; any out there?

Thanks.

A spreadsheet sort of analysis tool would help; any out there?

Thanks.