Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

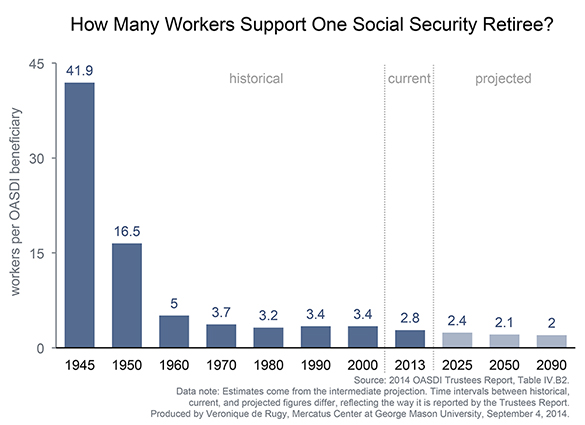

I would think something has to give...and there are no easy/obvious choices.

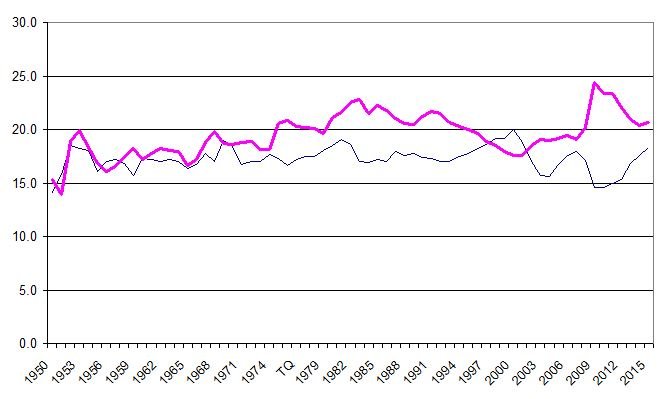

That chart is a little out of date so I ran one with numbers up until 2015 (same source)

Also not sure why the original chart starts in 1950 (actually, I am) but if you start it in 1980 the trend looks much different.

Attachments

Last edited: