HillCountry

Recycles dryer sheets

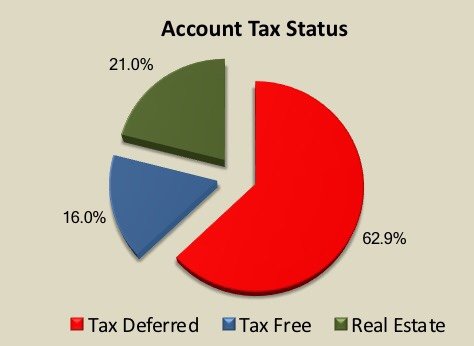

My holdings in tax advantaged accounts were at 70% of my net worth 10 years ago. Today they are just a bit above 15%.

In the order of size, we have my IRA, DW IRA, my 401K, 529, DW Roth, my Roth, HSA.

In the order of size, we have my IRA, DW IRA, my 401K, 529, DW Roth, my Roth, HSA.