You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Portfolio w/ S&P 500

- Thread starter ferco

- Start date

LOL!

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 25, 2005

- Messages

- 10,252

S&P500 fills the US large cap asset class in one's portfolio. It can generally be had at a low expense ratiio. For example VIIIX has an expense ratio of about 0.03%, SPY has e.r. of about 0.09%.

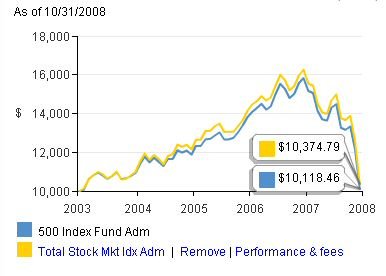

Many folks would recommend using a total US stock market index fund instead of just a US large cap fund. Such a fund would obviously fill the US large cap asset class as well with the additional benefit of giving you mid and small class.

There are other US large cap index funds that could fill this asset class.

If you don't believe in asset allocation and asset classes, then I guess this discussion could be moot.

Many folks would recommend using a total US stock market index fund instead of just a US large cap fund. Such a fund would obviously fill the US large cap asset class as well with the additional benefit of giving you mid and small class.

There are other US large cap index funds that could fill this asset class.

If you don't believe in asset allocation and asset classes, then I guess this discussion could be moot.

TromboneAl

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 30, 2006

- Messages

- 12,880

DblDoc

Thinks s/he gets paid by the post

- Joined

- Aug 11, 2007

- Messages

- 1,224

I use it as well as it is one of the few low cost mutual funds available in my plan. I flesh it out with the appropriate mid/small cap funds to approach the total stock market with a value tilt in our IRA's and with comparable ETF's in taxable.

DD

DD