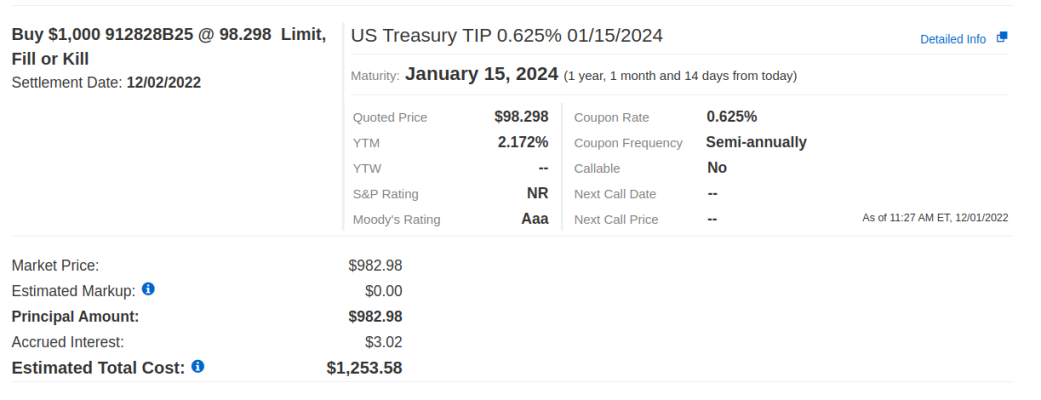

Venturing into the world of tips and confused about this on the secondary market. Looking at one maturing in about a year, price is quoted as 98.298 but total cost (I believe) includes the inflation adjustment (see attached screenshot).

My question is, suppose we have rampant deflation, at maturity would I receive the par value of $1000 and therefore have lost a bunch given my initial cost of ~$1250?

I thought tips bought at origination would, worst-case, return par value + the stated yield. Is this not the case on the secondary market, or am I just understanding things wrong (most likely).

Thanks,

John

My question is, suppose we have rampant deflation, at maturity would I receive the par value of $1000 and therefore have lost a bunch given my initial cost of ~$1250?

I thought tips bought at origination would, worst-case, return par value + the stated yield. Is this not the case on the secondary market, or am I just understanding things wrong (most likely).

Thanks,

John